FX Exposure and Hedging in Venture Capital. In the Venture Capital space, managing and calculating FX exposure has typically been cumbersome and overlooked.

The risky nature of the Venture Investing business of hitting 10x targets is not a matter of greed – the VC business simply requires the level of returns for the funds to yield returns.

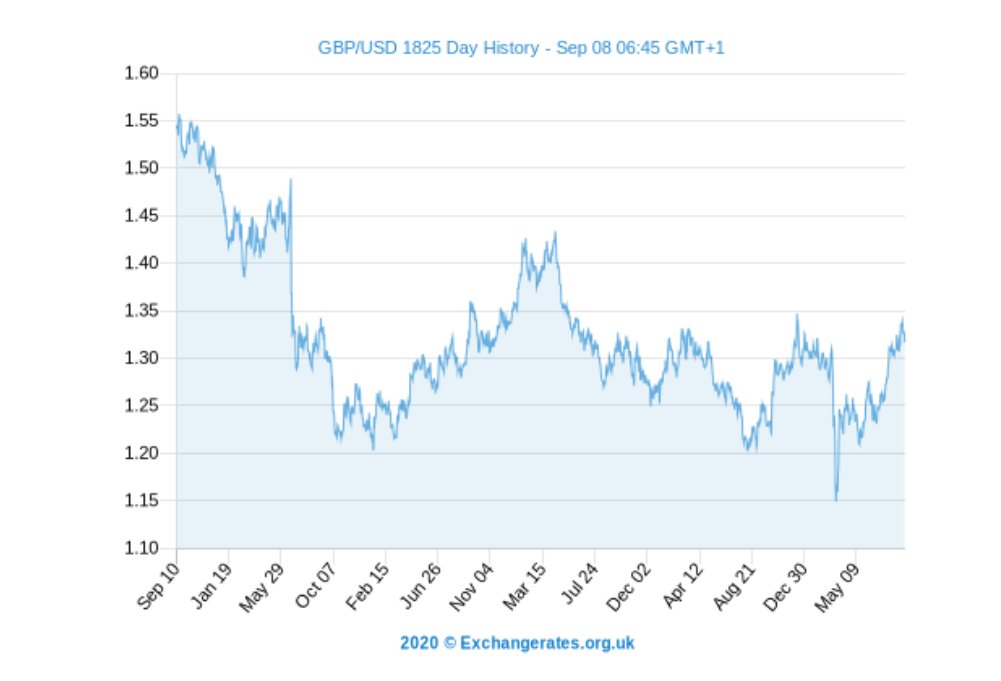

Surprisingly, there is not much talk about FX exposure and hedging FX risk, assuming of course that the fund has a multi-domicile strategy. For example, looking at the five year history of GBP to USD conversion rates, the FX rates range from 1.55 to 1.15, which is a 35% difference.

For VC Fund Transactions. Taking into consideration that VC firms aim for + 20% IRR, the FX exposure should not be undermined since it can play a major part in the IRR, once converting back into your originating currency. Even for such “stable” currencies like GBP and USD, there can still be significant volatility resulting in a very different IRR down the line.

How to calculate and display FX conversions. To display returns with FX Exposure, VC funds should use multiple FX rates; (i) the FX conversion rate of the day of the transaction and (ii) the FX conversion rate as of today. To display returns without FX exposure VC funds should use a single FX conversion rate. In the Rundit platform in Nov 2020, VC funds can see their returns with or without FX exposure with a switch of a button.

For Portfolio Company Financials and KPIs. If comparing two time periods i.e. Q4’2019 and Q4’2020 to calculate comparison figures, make sure to use the same currency conversion rate. It has been noted that some VCs convert the portfolio company financials and KPIs from currencies using monthly FX rate. This results in incorrect growth figures because you are not comparing them pari passu. In theory, if a company posts the same numbers throughout the year in parallel to an FX rate increase of 10%, the result would be displaying a false 10% growth in the portfolio company financials and KPIs.

How do VC Funds protect from FX Exposure. Venture Capital funds that have exposure to Foreign Exchange rates, large positions in portfolio companies domiciled in countries using other currencies, can use a hedging strategy to eliminate downside risk with currency swap forward contracts. A currency forward contract, or currency forward, allows the purchaser to lock in the price they pay for a currency in the future.

Rundit is a global platform for portfolio monitoring and management. With Rundit’s software tool for professional investors, you will get regular investment reports, manage your portfolio and get visual overviews of your fund performances in real time.