Table of Contents

Welcome back to the Rundit Monthly Roundup, your guide to the latest in startup and venture capital (VC)! 📊 🌱💡

April has been a landmark month for VCs and startups, marked by record-breaking funding rounds, the unstoppable momentum of AI, and a wave of innovation across industries. In this edition, we spotlight Rundit’s latest product update, showcase standout startup fundings, break down how AI is reshaping VC portfolio management, and share the must-attend events for investors and founders this summer.

Ready to catch up on what’s shaping the industry this April? Let’s get started!

We’re thrilled to introduce the Rundit Add-in for Excel 🔥 – a powerful new way to make managing your investment data faster, easier, and more efficiently. Whether you’re diving into portfolio performance, updating fund metrics, or preparing detailed reports, this add-in seamlessly connects Rundit with Excel, cutting out manual work and saving you valuable time and effort.

It’s not just an add-in; it’s a workflow game-changer that lets you:

The add-in is available for Excel on Mac, Windows, and Excel online. Learn more and get started here!

Not yet a Rundit user? Join us!

Here are some exciting startups currently fundraising:

| GlycanAge | Croatia |

| Industry: Biotech, Longevity |

| Round details: Series A – €5 million |

| GlycanAge is revolutionizing health-tech and longevity with advanced blood biomarkers developed from 30+ years of research and 200,000+ sample analyses. Leveraging the world’s largest proprietary dataset of the human glycome, GlycanAge is leading the way in predicting and preventing age-related conditions, beginning with menopause, cardiovascular disease, and neurodegenerative disorders. |

| AHILAB | United Kingdom |

| Industry: SaaS |

| Round details: Seed (MVP with tractions) – £650,000 |

| Gen AI apps are everywhere—305M users, 3M apps—but most can’t make money because they lack the right data. Founded by an ex-Meta Data Scientist and a Silicon Valley Software Engineer, Ahilab solves this problem by turning AI interactions into useful insights. Our first focus: monetization. We built the first ad network for Gen AI apps, placing relevant, data-driven ads inside AI-generated content—like Google Ads but optimized for AI. We started a Gen AI focused startup accelerator program in October 2024 and completed it last month. As of today, we process on average 525K API requests a month and are tapping into a $3.3B market. We are raising £650K in funding, to scale to £60K MRR and 5M monthly API requests. |

| Vegaaniruoka.fi (Veru Oy) | Finland |

| Industry: Online Marketplace |

| Round details: Pre-Seed – €100,000 |

| Vegaaniruoka is Finland’s biggest vegan food e-commerce, growing 35% quarterly with €2,625 monthly revenue. Our team’s 10+ combined years in e-commerce gives us a unique set of skills and experience to dominate the market. Seeking €100K pre-seed to scale marketing, expand across Nordics, targeting €200K ARR and €1-2M acquisition. Join us? |

→ Interested in connecting with these startups? We’d be happy to make introductions – reach out to us at [email protected]!

Get featured in our newsletter and gain visibility to 10,000+ investors.

April is shaping up to be an exciting month for venture capital and startups, packed with headline-grabbing funding rounds, bold new trends, and the unmistakable surge of AI innovation. Fintech is roaring back to life, with global startups raising over $10 billion in Q1 alone, the highest since early 2023. And big names like Plaid and Mercury are leading the charge with massive deals. Meanwhile, according to AllyWatch and VC News Daily, fresh capital is fueling everything from healthtech to cybersecurity, as investors double down on sectors reshaping the future.

But it’s not just about the money. AI is fundamentally transforming how VCs operate, automating everything from deal sourcing to LP communications and helping firms save up to 40% of their time on routine tasks. Sustainability and global expansion are also in the spotlight, with funds like Fluent Ventures backing entrepreneurs who are scaling proven models into new markets.

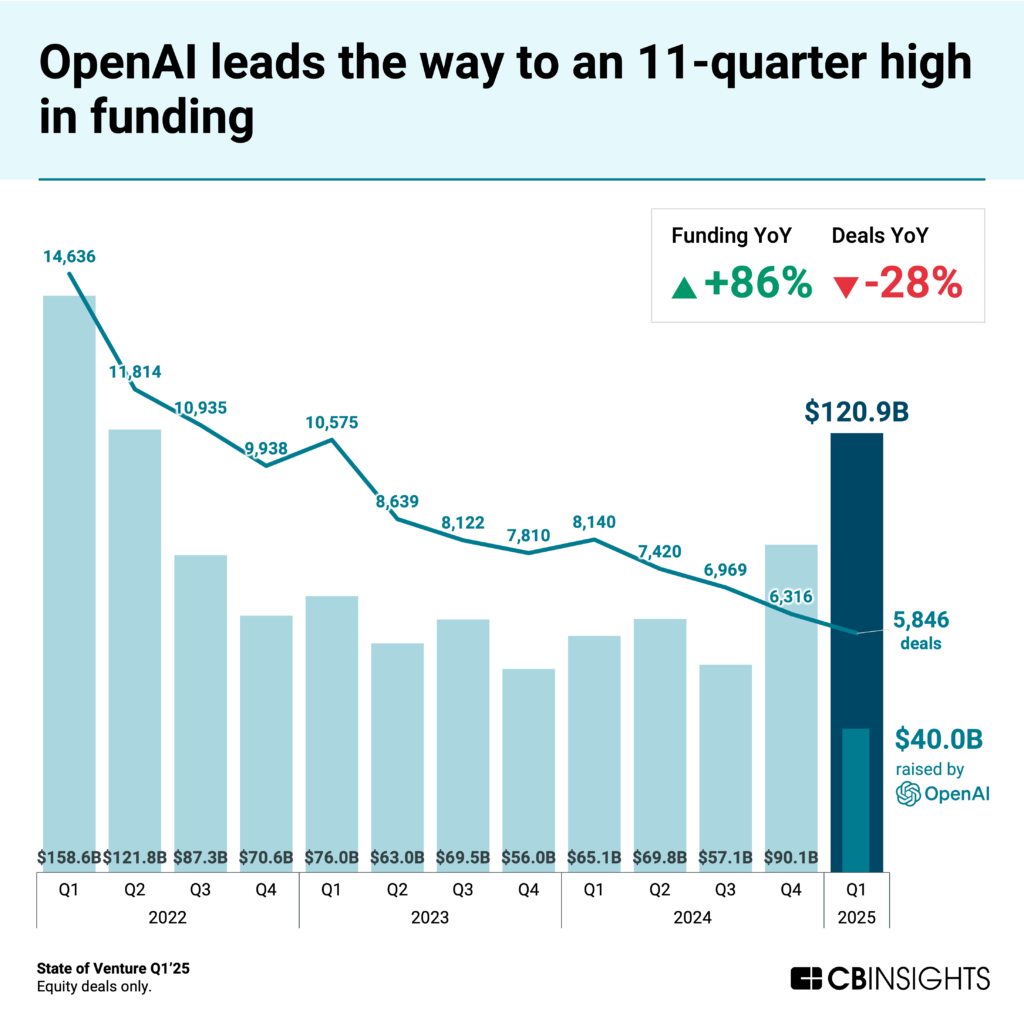

Source: CB Insights

The Q1 2025 CB Insights report confirms it: global venture funding soared to $121B, the highest since Q2 22, despite a drop in deal volume. The story? Bigger bets on fewer, more specialized opportunities, especially in AI. Median early-stage deal sizes hit a record $2.7M, and AI startups captured a historic share of global VC, with eight early-stage AI companies landing $100M+ mega-rounds.

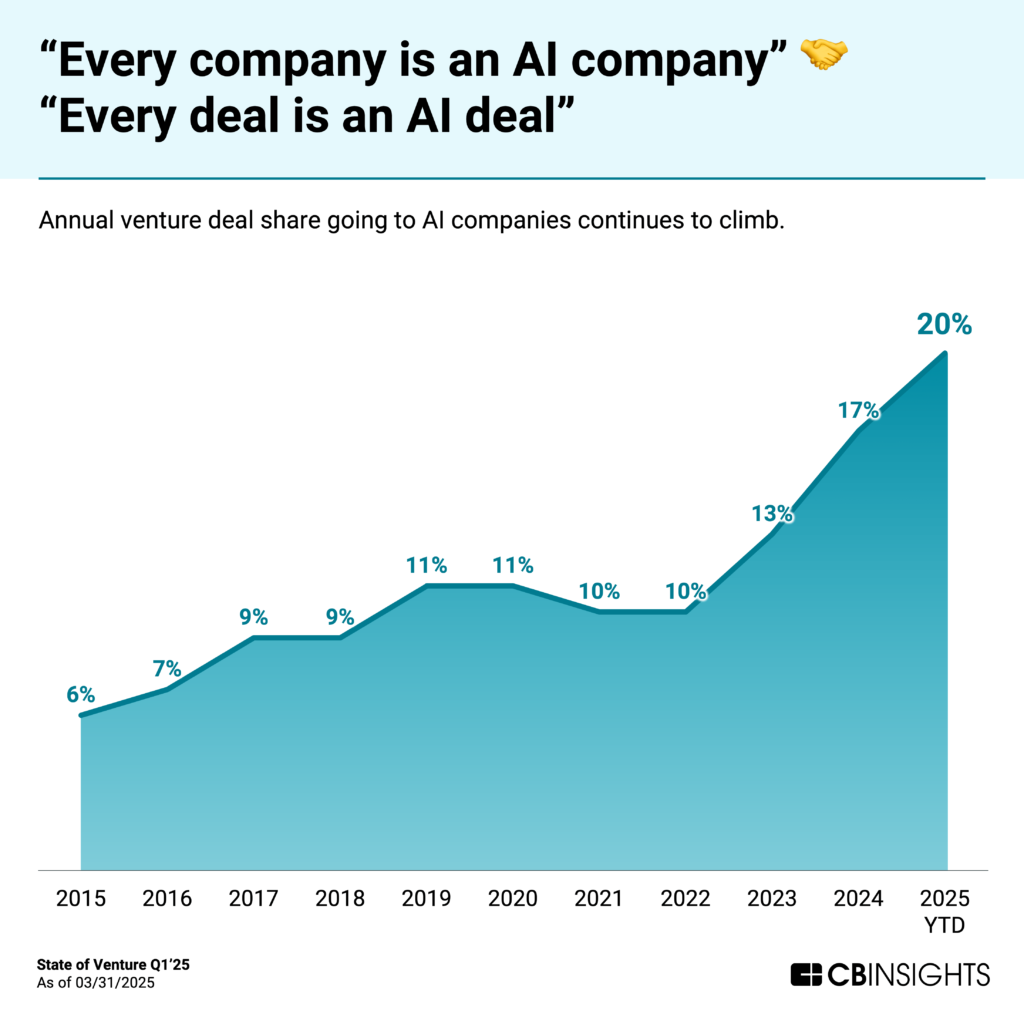

According to CB Insights report, AI now drives 1 in 5 global venture deals, with early-stage funding reaching record highs. Notable deals include OpenAI’s $40 billion funding round and Cyberhaven’s $100 million investment for AI-powered data security solutions.

Source: CB Insights

Forget the days when AI was just a buzzword in venture capital. In 2025, it’s the engine powering smarter, faster, and more confident decisions across the entire investment lifecycle. Today’s top VC firms aren’t just experimenting with AI; they’re weaving it into the fabric of their daily operations, and the results are transformative.

Read more from our blog – Data-Driven Decision Making: How AI is Transforming VC Portfolio Management in 2025

Here’s a closer look at some of the most significant startup investments this month:

| Startup | Sector | Amount Raised | Location | Notable Investors |

|---|---|---|---|---|

| Auradine | Web3/AI | $138M | Santa Clara, US | GSBackers, Samsung Catalyst, Mayfield |

| Chapter | Healthtech | $75M | New York, US | Addition, Stripes, Susa Ventures |

| ExaForce | Cybersecurity | $75M | San Jose, US | Khosla Ventures, Mayfield Fund |

| Vizzy | AI/Media | £3.65M | London, UK | Adjuvo, Rob Wells |

| SALZSTROM | Cleantech | $1M+ | Austria | Erste Group Bank AG |

| HyperFinity | Retail AI | 7-figure | Leeds, UK | Finance Yorkshire, River Capital’s fund:AI, Snowflake |

Mark your calendars for these can’t-miss events:

Written by

Jolie Pham – Marketing Manager @ Rundit

📅 Don’t miss out! Subscribe to our monthly roundup for the latest industry trends, funding opportunities, and exclusive insights – delivered straight to your inbox!