Table of Contents

Investor reports are vital for any startup business. It’s important to update your investors on the changes your company experiences. Reporting to your investors helps build trust with them as well. Financial dips and peaks, new expenses, market changes, important hires, and more are all critical pieces of information that your investors want to know about. This is because your investors not only fuel your business. They also provide you with helpful advice, expertise, and networks to help you succeed.

Here’s where investor reports come in.

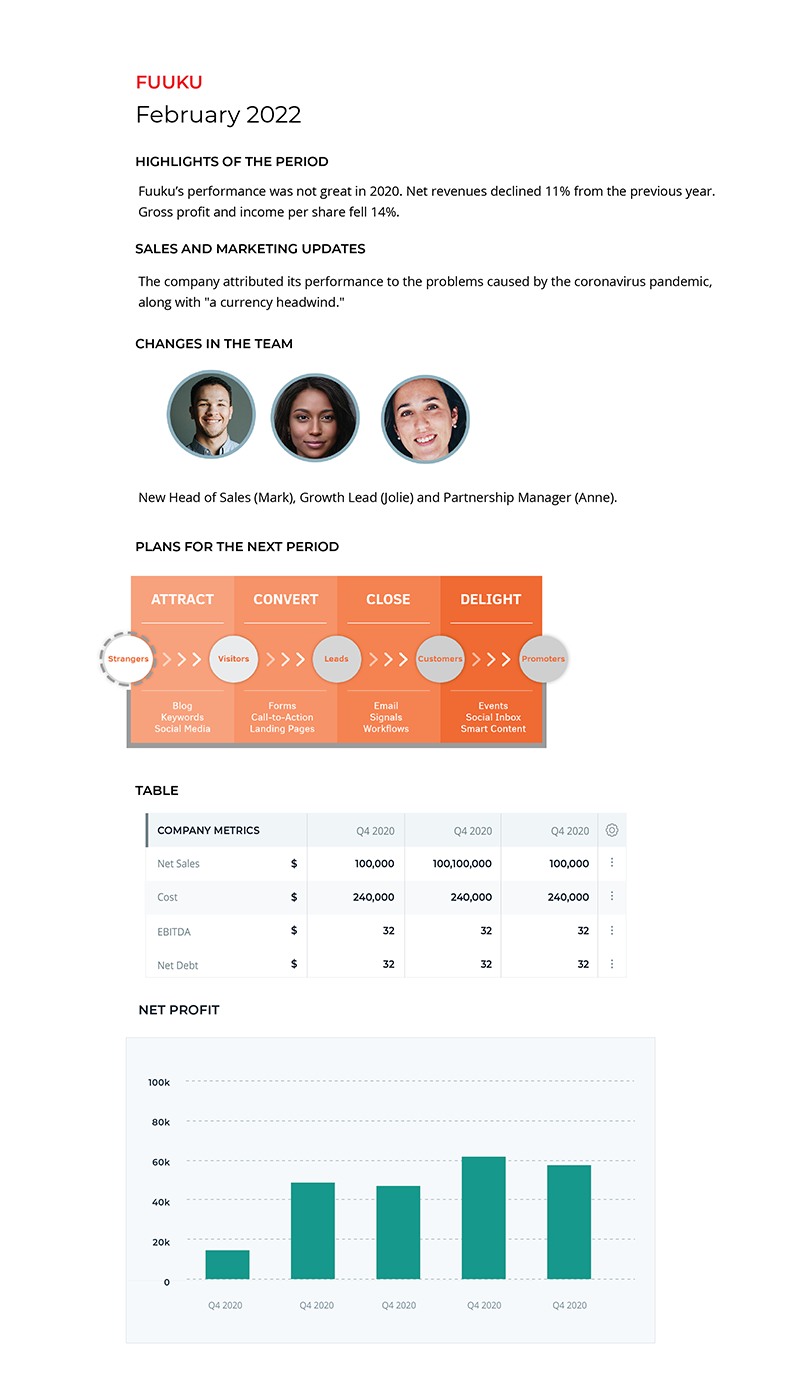

Your investor report should give your investors a snapshot of your company’s trajectory. Show your investors how you’re killing your financial goals, and keep them in the loop of any setbacks that you need support with. Here are some best practices for your investor update:

Keep them consistent: Your updates should be consistent in both frequency and format. Consistent formatting lets your investors compare reports with ease, and consistent reporting builds trust with your investors.

Give an all-encompassing picture: Most investor updates include these five areas:

Apart from the written updates, startups should also include key metrics and data in their investor reports. Metrics are great indicators of a company’s progress, strengths, and areas for improvement. But, which metrics make the cut? Here’s a list of 15 metrics to consider when drafting your investor update report:

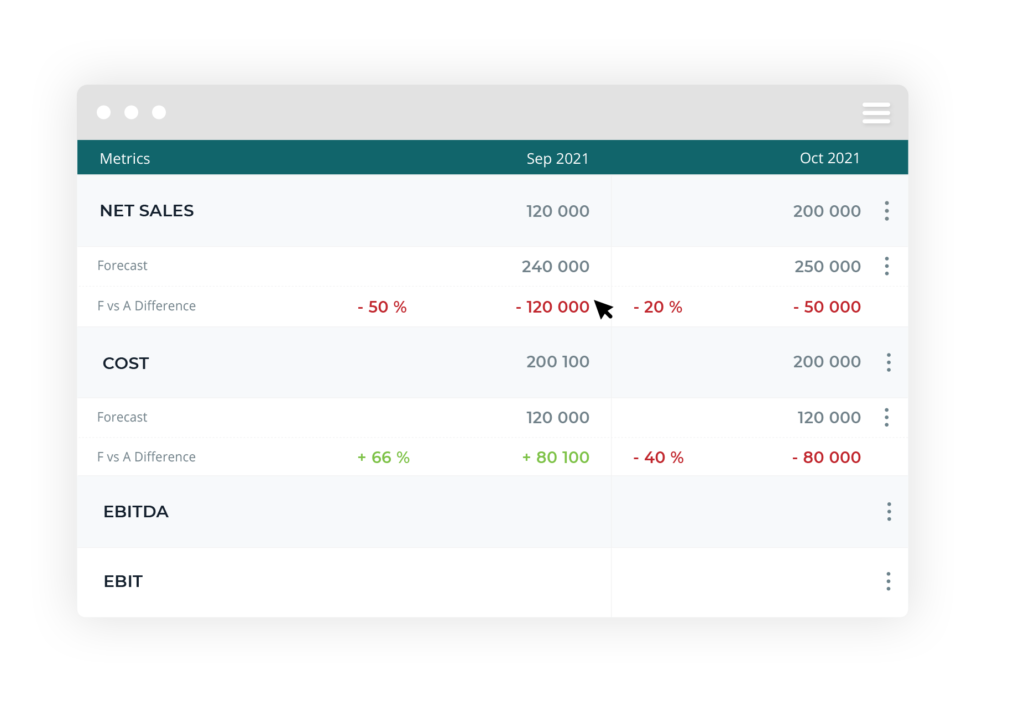

Qualitative and Quantitative updates are obviously really important, however, VC and Angel investors are keen to know how you are performing compared to your forecasts. Typically you should report the difference as a percentage and as a whole number.

Want to make investor reporting hassle-free? Look no further than Rundit’s investor reporting tool. Our platform offers comprehensive investor reporting features, making the process of startup investor reporting a breeze, as you can see in the demo video below:

Conveniently share business updates with all your investors from one single platform.