Table of Contents

The venture capital industry is undergoing a fundamental shift, driven by the rapid advancement and integration of artificial intelligence (AI) technologies. As we navigate through 2025, the traditional approach to portfolio management, relying heavily on intuition, network insights, and historical data, is being revolutionized by AI-driven analytics, automation, and predictive modeling.

With AI’s ability to continuously analyze real-time data, portfolio managers are gaining a significant edge in making informed investment decisions while minimizing inefficiencies. This technological leap is not just an upgrade, it’s a strategic necessity for optimizing financial outcomes in an increasingly complex and competitive market landscape.

In January 2025 alone, AI-related companies garnered $5.7 billion in funding, highlighting the sector’s continued growth. As AI becomes more integral to VC operations, it’s crucial to understand its impact on investment strategies and outcomes. Investment managers who fail to integrate AI into their workflows risk falling behind, while those who effectively harness its power are reaping unprecedented advantages. These benefits span across the entire investment lifecycle, from better deal sourcing and smarter risk assessment to more precise portfolio optimization and enhanced reporting capabilities.

| 1. AI-Powered Deal Sourcing |

| 2. Risk Assessment and Due Diligence |

| 3. Portfolio Optimization with AI Insights |

| 4. AI-Enhanced LP Reporting to Streamline Communication with Limited Partners |

| 5. Challenges & Limitations of AI in VC Investing |

One of the biggest challenges for VCs is identifying promising startups before the competition. AI is revolutionizing deal sourcing by automating lead generation and pattern recognition at a scale that was impossible just a few years ago.

With these AI-driven insights, VCs can move beyond warm introductions and traditional sourcing methods, allowing them to find high-potential startups earlier and with greater accuracy.

Venture capital is inherently risky, but AI is transforming how investors evaluate startups and mitigate downside risks. Traditional due diligence processes often rely on fragmented data and subjective opinions, whereas AI aggregates vast amounts of structured and unstructured data to generate objective risk profiles.

By integrating AI into risk assessment workflows, investment managers can make more informed decisions, reducing exposure to underperforming investments and avoiding high-risk deals that might have been overlooked with traditional methods.

Related article: Due Diligence Checklist for Investors: Essential Steps for Assessing Investment Opportunities

Managing a VC portfolio isn’t just about selecting the right startups—it’s about continuously monitoring, adjusting, and optimizing investments. AI is making it easier for firms to manage their portfolios dynamically by providing real-time insights into startup performance, market conditions, and exit opportunities.

Related article: Optimizing VC Portfolio Performance: Advanced Strategies for 2025

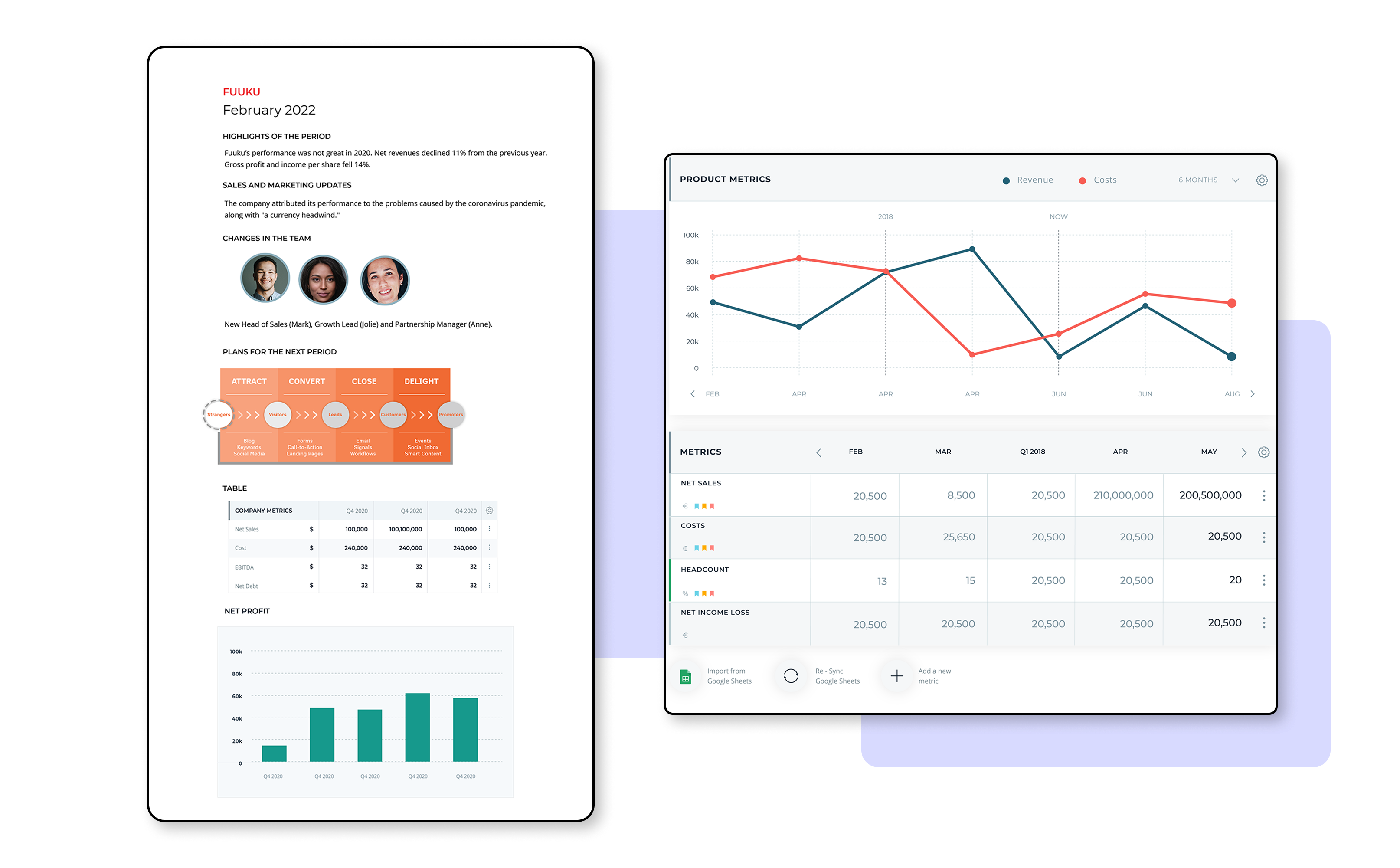

Effective communication with Limited Partners (LPs) is crucial for maintaining trust and transparency. AI-powered tools are now transforming LP reporting by automating data collection, analysis, and presentation.

By leveraging AI in LP reporting, venture capital firms can enhance productivity, ensure compliance with industry standards, and foster stronger relationships with their investors.

Despite its advantages, AI is not a silver bullet. VCs must be aware of its limitations and potential pitfalls:

The most effective investment managers in 2025 will blend AI insights with human intuition, leveraging the strengths of both to make smarter investment decisions.

Related article: Top 10 Automated Risk Assessment Tools in 2025

AI is no longer an experimental tool in venture capital, it’s becoming a necessity. From deal sourcing to risk assessment, portfolio management, and LP reporting, AI is reshaping how VCs operate, enabling them to move faster, make more informed decisions, and optimize returns.

As we delve deeper into the transformative impact of AI on venture capital, it becomes clear that the future belongs to investment managers who can seamlessly blend cutting-edge technology with human expertise. In this new era of data-driven decision making, AI is not replacing human judgment but rather augmenting it.

By integrating AI into their workflows, VCs can build more resilient, high-performing portfolios that are better equipped to navigate market uncertainties and evolving investment paradigms. The most successful firms will be those that embrace AI not as a substitute for human insight, but as a powerful enhancement tool, enabling them to thrive in an increasingly competitive and complex investment landscape.

Subscribe to our newsletter

Sign up to receive our newsletter for exclusive updates, insights, and exciting news delivered straight to your inbox.

Try Rundit and centralize your investment data into one source of truth!