Table of Contents

Measuring fund performance allows VC investors to assess the success of their investments. By understanding which investments are performing well and which ones are not, investors can make informed decisions to maximize returns on their portfolio, manage risks and identify areas to improve.

1. Gross IRR

The internal rate of return (IRR) is a popular metric that investors use to predict the profitability of their investment. The IRR is the expected rate of growth for an investment. Specifically, the IRR of a project shows you the annual growth the investment will experience.

IRRs help investors and companies analyze investment returns and predict yearly returns, even if cash flow varies throughout the course of the project.

Here’s the most widely used calculation for IRR:

2. Invested Amount

Self-explanatory, the invested amount is the amount of money you put into a certain investment. While this number is meaningless on its own, it’s particularly helpful compared with other metrics, like return on investment (ROI) and IRR.

Ownership

Ownership refers to the proportion of ownership your fund owns in a company. For example, high ownership in a portfolio company may mean more decision-making authority than other investors.

You can calculate ownership by multiplying the price per share by the number of shares your ownership percentage corresponds to.

Most commonly, VCs calculate the total number of shares in a portfolio company on a fully diluted basis (includes, for example, ESOP and convertible notes assuming they are converted).

Here’s a basic calculation of ownership:

3. Multiple

Multiple of Invested Capital – MOIC (or Total Value to Paid-in Capital), also known simply as “multiple,” is a metric that tells investors how much money they’re getting from an investment. Multiples don’t consider time in the equation, so it’s crucial to compare multiples to other metrics.

Here’s a calculation to find your MOIC:

4. ROI

One of the most popular VC fund metrics, ROI stands for Return on Investment. ROI tells you the profitability of an investment and compares the amount of an investment’s return to the investment cost. ROIs are expressed either as percentages or ratios. Positive percentage ROIs usually indicate that a project is profitable, while negative percentage ROIs indicate a loss.

A simple formula to calculate ROI is:

5. Total Cash Realized

Many VC metrics predict returns on investments without those returns taking place. There’s a system behind each one, but it’s important to note that any metric predicting a future gain is unrealized. Total cash realized is the number of gains that an investor received as a return in cash.

6. Fair Value

Fair value is the estimated value of a company or investment, or the estimated amount of money that a company or investment can be sold for.

For example, VCs use discounted cash flow (DCF) analysis to calculate a company’s fair value or investment. This formula assumes that the value of an investment is the total value of its future cash flows at today’s prices. In other words, this valuation demonstrates the cash that a company’s shareholders can distribute upon selling the company.

To maintain success in the long term, it’s essential to know what drives performance within your portfolio companies and your fund.

There’s a plethora of metrics available to measure VC fund performance. But let’s be real, keeping track of seven metrics for just one fund is already quite time-consuming. Imagine the hassle of handling multiple funds – two, three, or even more! That’s where Rundit comes in, making life easier for venture capitalists to measure their investment progress efficiently.

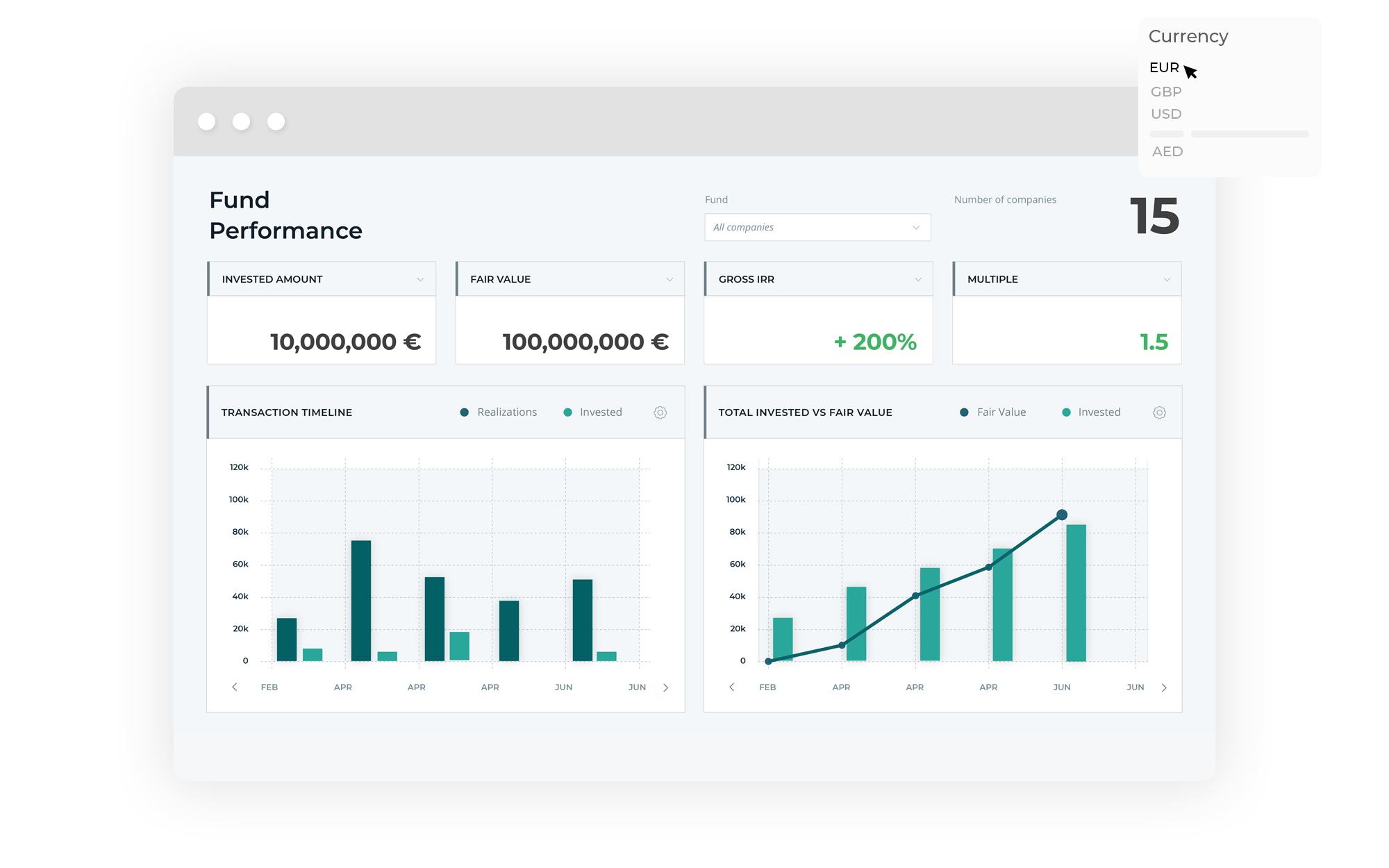

Our portfolio management software does the heavy lifting for you by automatically calculating key metrics like Gross IRR, Multiple, Fair Value, Ownership, Invested Amount, Return on Investment, and many others. And the best part? You get to view all this investment data on visual dashboards, providing you with a precise overview of your fund’s performance.

Example of Investment overview dashboards in Rundit platform.

And here’s another nifty feature – you can easily share your fund performance data with your Limited Partners. Exporting data into well-structured LP reports is a breeze, impressing your LPs and keeping them in awe of your fund performance.

Are you looking for efficient ways to measure your venture capital fund performance? Book a call today to manage your portfolio with greater efficiency.

Get holistic insights and make decisions from a unified data source.