Table of Contents

Mastering the nuances of startup investments demands a deep understanding of various financial dynamics, with one of the most critical concepts being liquidation preference. Whether you’re an investor, a founder, or an employee holding stock options, grasping this concept is essential—especially in situations where a promising acquisition might leave your shares with little or no value.

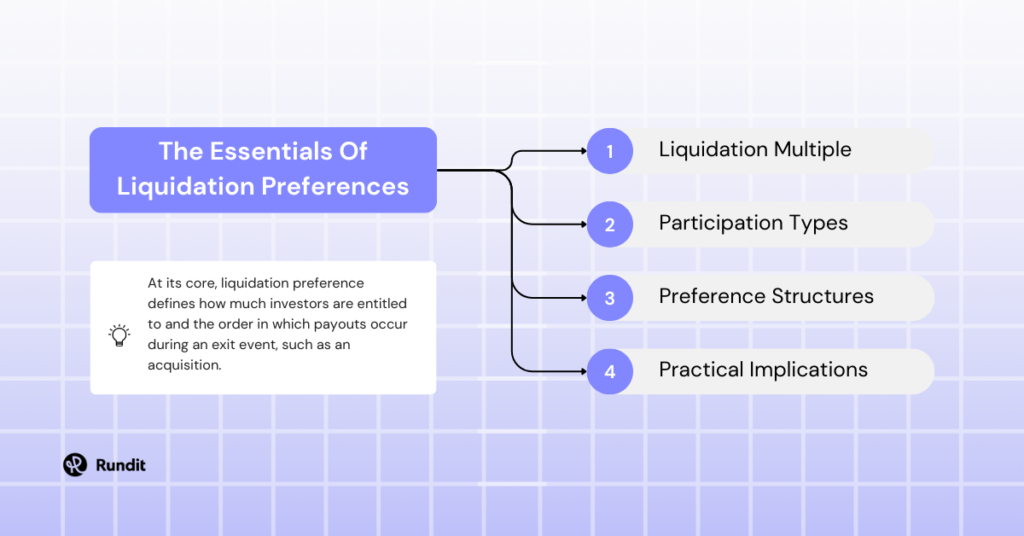

This guide breaks down the essentials of liquidation preference, including key terms like liquidation multiple, participation types, preference structures, and their practical implications. Through detailed scenarios and examples, stakeholders can gain the clarity needed to make well-informed decisions and protect their financial interests in startup exit scenarios.

At its core, liquidation preference defines how much investors are entitled to and the order in which payouts occur during an exit event, such as an acquisition.

Liquidation Preferences essentially answers two critical questions:

By establishing a clear hierarchy and distribution method for proceeds, liquidation preferences provide a safety net for investors while potentially affecting the returns for founders and other shareholders.

The liquidation multiple determines the priority payout to investors before common shareholders receive anything. For instance, an investor who contributes $5 million with a 1x liquidation preference will receive $5 million before any remaining funds are distributed, assuming the acquisition amount covers this obligation.

The sequence in which investors are paid can dramatically influence outcomes:

Example: Funding Rounds and Liquidation

Consider a company that raises $1 million in a seed round at a $5 million valuation and later secures $3 million in Series A funding at a $15 million valuation. Both rounds have 1x liquidation preferences. If the company sells for $4 million:

Understanding liquidation preferences and their variations—whether participating or non-participating—is critical for navigating startup exits. Decisions about converting shares or exercising preferences depend on acquisition valuations, funding structures, and investor terms. With proper knowledge, stakeholders can better negotiate and safeguard their financial interests in this complex yet rewarding landscape of startup investments.

Rundit transforms the complexity of liquidation preferences into clarity, offering startup founders and investors a powerful platform that demystifies financial nuances with precision and ease.

Our solution goes beyond traditional tracking, providing:

By leveraging Rundit’s powerful features, startup ecosystem participants can save time, reduce errors, and gain valuable insights into their potential returns under various exit scenarios. Whether you’re a founder trying to understand the implications of your cap table or an investor managing a portfolio of startups, Rundit offers the tools you need to navigate the complexities of liquidation preferences with confidence.

Ready to simplify your startup financial management and gain clarity on liquidation preferences? Schedule a demo with Rundit today!

Generate portfolio and fund report from a unified data source.