Table of Contents

Venture capital investment isn’t just about finding unicorn business ventures and reaping the rewards. Before seeing any returns, VCs must be on top of any relationships they have concerning their investment.

One of the most important relationships within a VC fund is between General Partners (GP) and Limited Partners (LP).

Limited Partners, also known as “silent partners,” purchase shares in exchange for partial ownership in a company. However, Limited Partners aren’t involved in day-to-day operations.

General Partners are founding members of a startup or investment. Often full-time employees, GPs see more of a project’s day-to-day operations, and are responsible for sharing many business responsibilities and expenses. Some GP responsibilities include:

So, LPs are a fund’s investors while GPs manage that fund.

A Limited Partner (LP) Report is a critical document in venture capital (VC) that serves to keep Limited partners informed about the performance and activities of the VC fund in which they have invested. Transparency, clarity, and comprehensiveness are essential elements of these reports. Here is a general outline of what could be included:

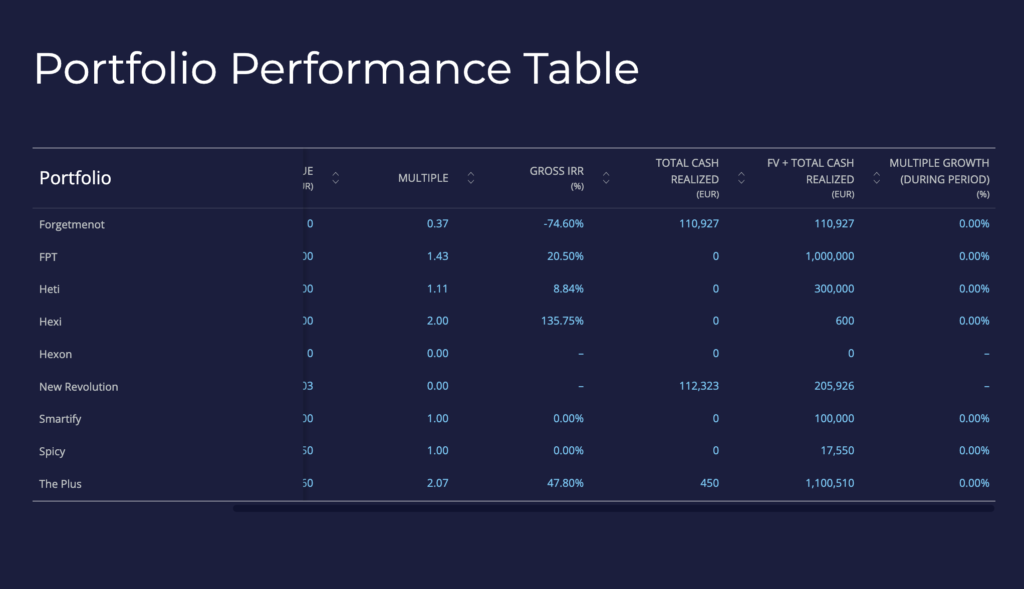

1. Fund Performance Metrics:

2. Cash Flow Summary: High-level overview of cash inflows and outflows during the period, along with the opening and closing cash balance.

1. Capital Called: Amounts called during the period, with a breakdown by purpose.

2. Distributions Made: Details on distributions returned to LPs, categorized by source (e.g., exits, dividends).

3. Remaining Commitments: Indication of uncalled commitments and potential future capital calls.

Transparency on management fees, performance fees, and other costs.

1. New Investments: Description of new companies added to the portfolio.

2. Follow-on Investments: Additional investments in existing portfolio companies.

3. Exits: Companies sold or gone public and the returns generated.

4. Valuation Changes: Significant changes in portfolio company valuations.

5. Portfolio Performance: News, milestones, and updates on the entire portfolio or individual company performance.

The reporting requirements for GPs are extensive and may vary depending on guidelines such as ILPA and InvestEurope. LPs are increasingly desiring higher frequency and more detailed reports, making operational efficiency of GPs a more common assessment criterion for VCs. Some LPs may even want reports on more than a quarterly basis.

While GPs want to comply, it’s not always easy to prepare all the requested information, and GPs need to ensure reports are flawless before sharing them. Creating LP reports can also be time-consuming.

The LP report is an important way for your VCs to keep your investors informed and maintain strong investor relations. Some VC firms may also use automated tools, such as Rundit’s LP report feature, to help generate, organize, and share the necessary information with their LPs. Rundit’s interactive LP report allows VCs to structure aggregated data for easy sharing with their LPs.

Maintaining healthy relationships and engaging with Limited partners is crucial for General partners. Thus creating an LP report that stands out is one way to achieve this goal. It helps your VC manage investment data, stay organized, and meet LP reporting requirements.

Are you looking for an efficient way to create and share LP reports with your Limited Partners? Book a call today and let us walk you through our LP reporting functionality.

Consolidate your portfolio and fund data in one single report.