Table of Contents

The recent changes in SEC’s private fund advisor rules have sent ripples through the financial landscape, particularly impacting fund managers. These regulations usher in a new era of compliance, demanding precision, transparency, and streamlined reporting from managers.

Even though the Commission eased up on its original proposals, the new requirements mean the SEC will now keep a closer eye on private fund advisers. This includes both those registered with the SEC and exempt reporting advisers, such as managers of venture capital funds.

The SEC’s latest changes and amendments introduce stringent compliance requirements for fund managers. The hurdles include meeting standardized reporting obligations, conducting regular audits, managing restricted activities, and maintaining meticulous records. These regulations pose a significant challenge for fund managers, especially concerning the complexities of LP reporting.

Adhering to these mandates necessitates precision in reporting formats, ongoing audits, and meticulous compliance reviews. It also demands transparent documentation of restricted actions and the creation of comprehensive yet clear LP reports. Striking a balance between operational flexibility and compliance responsibilities remains a crucial aspect, as fund managers strive to meet investor expectations while adhering to these stringent regulations.

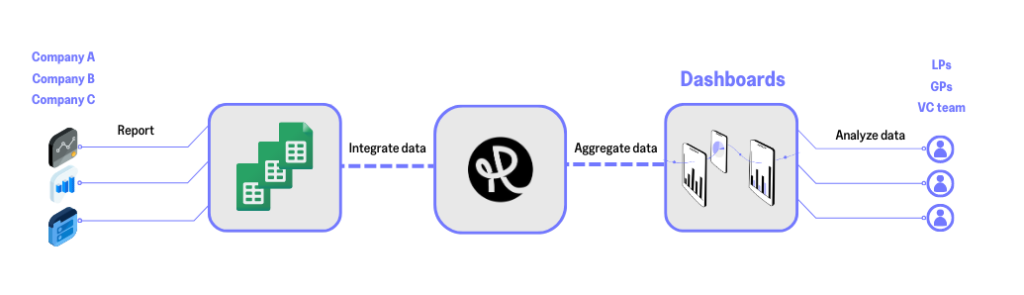

The Limited Partner (LP) report serves as a crucial medium for VCs to ensure investors are well-informed, fostering robust investor relations. Many VC firms leverage automated solutions like Rundit’s LP report feature to streamline the creation, organization, and distribution of essential data to their LPs.

Rundit stands as a beacon in the maze of SEC compliance, aligning seamlessly with the new SEC rules. Its tailored features serve as a comprehensive solution, simplifying LP reporting while ensuring adherence to regulatory standards. Rundit’s functionalities encompass standardized reporting formats, audit facilitation, and robust recordkeeping capabilities, directly addressing the SEC’s stipulations.

Rundit dives deep into the various facets of the SEC rules, seamlessly assisting with quarterly statements, facilitating mandatory audits, managing restricted activities, and other compliance needs outlined by the SEC.

Through Rundit, fund managers can witness a tangible improvement in their operational efficiency, a critical aspect in navigating the intricate world of SEC compliance.

The proposed regulations signify an expansion of SEC oversight over all private fund advisers, particularly when considered alongside recent rulemaking actions. Investment in private funds typically targets qualified purchasers and accredited investors, whom the SEC has traditionally deemed “sophisticated” and capable of self-preservation. However, with the proposed rule changes introducing prescriptive disclosures and prohibiting certain practices, the SEC aims to impose a regulatory framework more akin to that found in retail-focused investments.

In the realm of navigating the complexities of SEC compliance, Rundit emerges as a strategic ally for fund managers. Its seamless integration with the new SEC rules positions it as an indispensable tool in ensuring compliance while fostering operational efficiency.

Are you looking for an innovative solution to generate and distribute LP reports to your Limited Partners? Schedule a call with us today, and explore our comprehensive LP reporting capabilities.

Access consolidated insights from a unified data source for streamlined compliance with the latest SEC private fund rules.