Corporate Venture Capital (CVC) refers to the investment of corporate funds directly in external startup companies. This form of venture capital is typically a subset of a larger corporate strategy to foster innovation and gain competitive advantages. CVC is often structured as a subsidiary of the larger corporation, which may or may not have other venture capital operations.

The goals of Corporate Venture Capital can be various and may differ significantly from traditional venture capital firms. While financial return on investment is certainly a factor, corporations may also be interested in strategic goals, for example:

Despite the complexities, CVC has been a significant force in the startup ecosystem and continues to grow in relevance as corporations seek faster, more effective means of driving innovation and staying competitive. However, managing investments in startups involves complexities that go beyond simple financial tracking. Given the strategic goals, governance requirements, and often more complex set of stakeholder relationships involved, a well-designed portfolio management system can offer significant advantages:

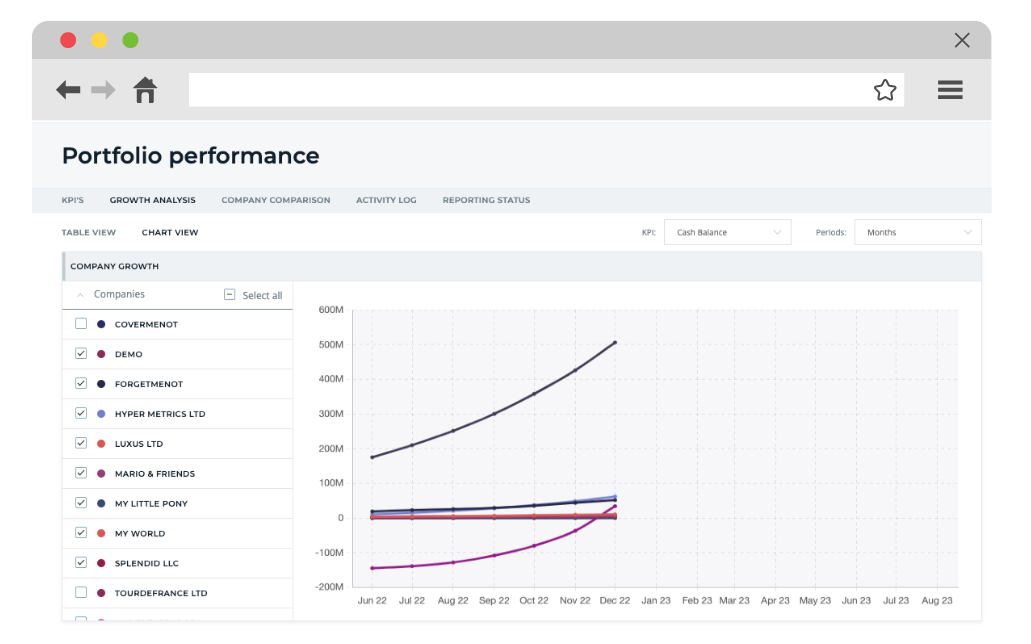

1. Strategic Alignment: Unlike traditional VC firms, CVC units need to ensure that their investments align with the broader corporate strategy. A portfolio management system like Rundit can help track how each investment meets specific strategic goals and objectives, providing metrics or key performance indicators (KPIs) that can be reported to senior management.

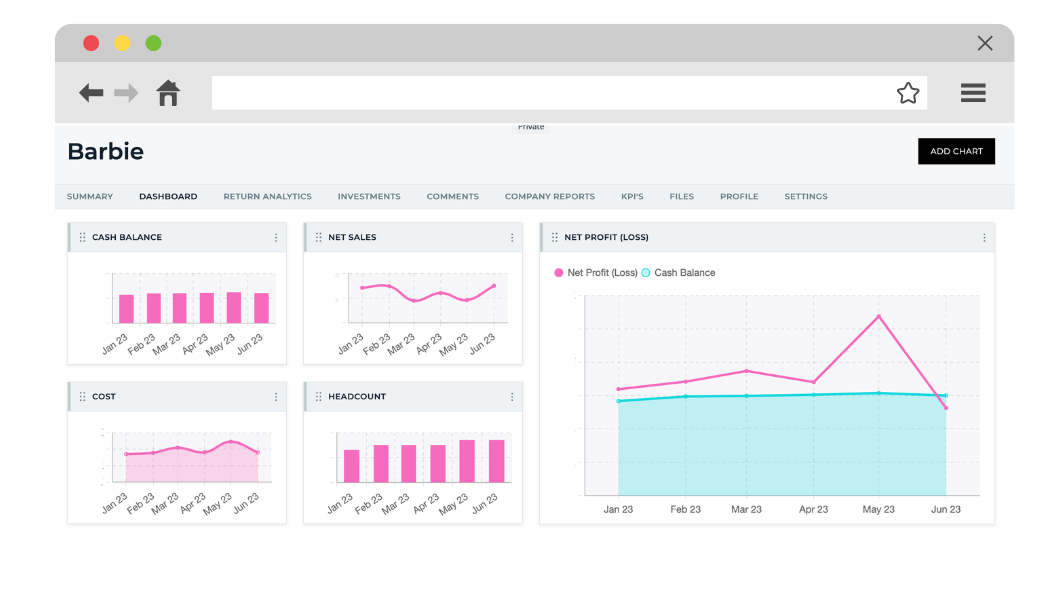

2. Performance Monitoring: This involves the continuous assessment of portfolio companies against financial and strategic objectives. A portfolio management tool like Rundit can provide dashboards and reports for real-time monitoring (as seen in the picture below).

3. Reporting: CVCs have to adhere to corporate reporting requirements. A dedicated solution can streamline the documentation and reporting processes, ensuring that compliance can be more easily achieved.

4. Scalability: As the number of investments grows, managing them manually or through basic spreadsheets becomes increasingly impractical. A portfolio management solution allows a CVC to efficiently scale its operations.

5. Collaboration and Communication: Good portfolio management software allows for easier collaboration among team members and can facilitate better communication with other departments within the corporation, as well as with the startups themselves.

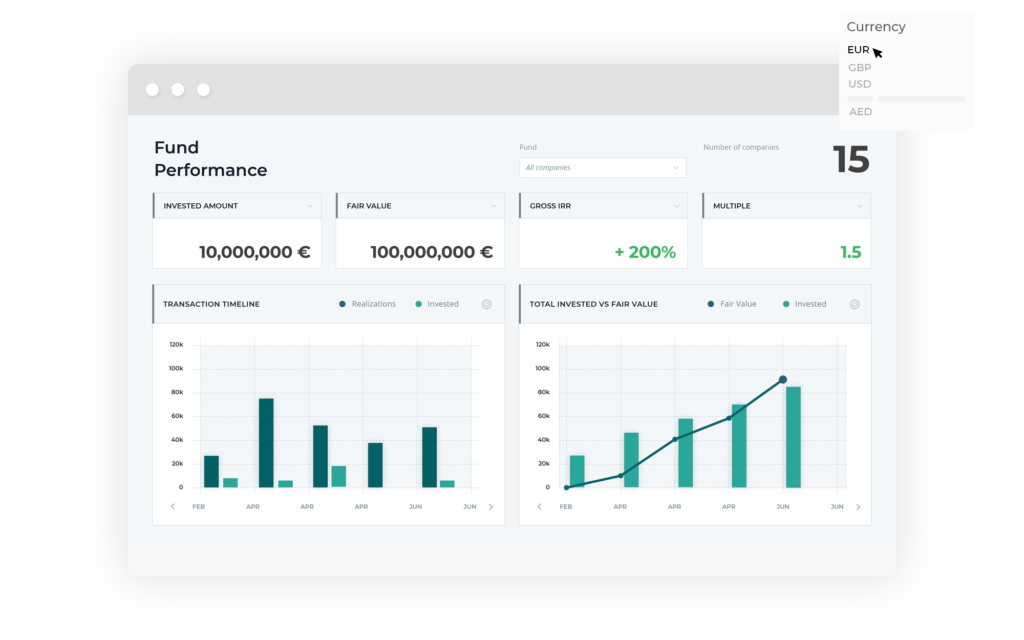

Given these complexities and the potential for significant impact on the parent company’s broader business, many CVCs consider a dedicated portfolio management solution to be not just useful, but essential for effective operations. Rundit is a portfolio management and monitoring tool that powers a source of truth that brings all investment and portfolio data together via data integration and provides CVC investors with holistic insights into portfolio company and investment performance. Book a call with our expert today to learn more.

Get holistic insights and make decisions from a unified data source.