Table of Contents

VC teams regularly hold internal and external meetings to discuss potential investments and monitor the performance of existing portfolio companies. A collaborative and data-driven approach is a key element that influences the outcome of these meetings. In this article, we will explore the factors that drive efficiency in a typical VC Monday meeting and tips to revamp your internal meetings for increased productivity and collaboration.

Depending on the VC’s culture, size, and investment strategy, its Monday team meeting can vary in terms of discussion points, length and how it is run. However, there are some common topics that are typically presented in these meetings:

Deal flow discussion: Partners will review potential investments that have been identified through their network, referrals, or through inbound requests. They will evaluate the pitch decks, financial projections, and other relevant information to determine if the company fits the investment criteria.

Investment decisions: Based on the discussions and evaluations from the deal flow review, partners will evaluate the merits of different investment options.They may also discuss how much to invest, the terms of the investment, and other details.

Portfolio review: Partners will discuss the progress of their current portfolio companies. They will review key performance metrics, identify potential issues or areas for improvement, and discuss the strategies for each company.

Review of the VC firm’s financial and operational performance: This included the status of fundraising efforts and the performance of existing investments. There may be discussions about the operations and strategy of the firm itself, including the due diligence process, event planning, staffing, marketing, business development, and other operational matters.

Industry updates: There may be a discussion of industry trends and news, as well as updates on competitors and market developments.

Team updates: Internal meetings in VC firms often provide an opportunity for team members to share information and insights on different topics and collaborate on problem-solving.

Now, let’s turn to the question of which method VC teams use to present information during their internal meetings. VC teams may use various methods to present information during their internal meetings. Some common formats include:

Regardless of the format a VC team chooses, the effectiveness of presenting and interpreting data can have a significant impact on the thought process, the flow of discussion, and meeting outcomes, and ultimately determine the success or failure of a meeting.

Effective data presentation is about presenting information in a clear, concise, and visually appealing manner. This can be achieved by using charts, graphs, or other visual aids to make complex data easier to understand.

If data is presented effectively, it can support the points being made and help persuade other team members to a particular investment decision. For example, a well-designed graph or chart can quickly and clearly communicate important financial metrics such as revenue growth or profitability, helping the investment team to evaluate the performance of a portfolio company or potential investment opportunity.

Choosing the right method to showcase data and information is just as critical as the process of prepping the internal report or presentation. According to Elena Pikulina, VC Associate at Relay Ventures, preparing for Monday’s report took her at least 3 hours every Friday. Gathering all the necessary information from partners and team members involved in the portfolio companies, then compiling this data into reports for the team meeting on Monday is a time-consuming process.

Overall, the method used to present information during internal meetings will depend on the specific needs and preferences of the VC team, as well as the type of information being presented. Still, one or two VC Associates or one VC team member would be responsible for putting together all information before every meeting. And this can be a mood-killer task since it considerably takes time and resources.

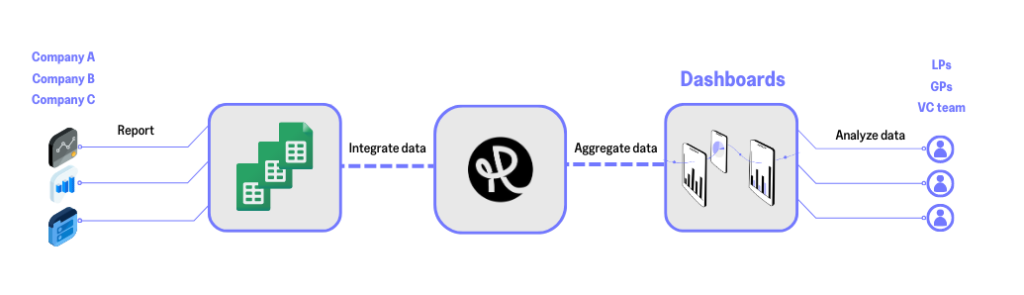

Using a portfolio management and monitoring tool like Rundit can help VC teams prepare internal reports in fewer hours with less effort and make meetings more effective.

“Rundit’s dashboards save me at least 3 hours from preparing internal reports every Friday.”

Elena Pikulina, Associate @Relay Ventures

Here are some ways in which Rundit assists the team at Relay Ventures and many other VC teams:

“We collect portfolio companies’ key KPIs on a quarterly basis. Rundit aggregates this data and we process it into quarterly reports that reflect the startups’ performance over the last quarter.”

Talal Khatib, Investment Team @Access Bridge Ventures

“During our quarterly growth session with venture partners, we utilize Rundit as a supporting tool. This enables us to navigate between various portfolio views as the discussions evolve.”

Ana Pinheiro, Operations Manager @Mustard Seed Maze

In conclusion, VC Monday meetings (or VC internal meetings) play a crucial role in the operational process of VC firms. These meetings offer an opportunity for team members to collaborate, assess potential or current investments, and track the performance of existing portfolio companies. The effectiveness of the methods used to present information during these meetings can determine their outcomes and decision-making processes. Opting for a method that wouldn’t waste too much time and effort from your VC team is a must. Talk to our experts and learn how to revamp your VC Monday meeting for increased efficiency.

Get holistic insights and make decisions from a unified data source.