Table of Contents

Capital allocation is a critical component of venture capital investment. Capital allocation is an important factor in determining the return on investment, as well as the overall success of a venture capital fund.

Capital allocation in venture capital investment refers to the process of deciding how to invest and allocate financial resources within a venture capital firm. This involves evaluating potential investment opportunities, deciding how much capital to invest in each opportunity, and determining the most effective use of the firm’s financial resources to maximize returns for its investors.

Venture capital firms typically have a limited amount of capital to invest in startups, and therefore must make strategic decisions about where to allocate their resources to maximize their return on investment. Capital allocation decisions may involve evaluating a range of investment opportunities, including early-stage startups, growth-stage companies, and more established companies. The goal is to identify the investments that are most likely to generate the highest return on investment and create the greatest long-term value for the firm and its investors.

Portfolio allocation is critical in the investment strategy of a VC, ensuring that they can maximize returns, minimize risks and meet their investment objectives:

Diversification: By investing in a diverse range of startups, VC can reduce the impact of any adverse events that may occur.

Maximizing Returns: Portfolio allocation can help a venture capital firm benefit from the potential returns of different markets.

Managing Risks: By diversifying their portfolio, VC can spread their risk across different startups and reduce their exposure to any one particular startup. This can help to protect their portfolio against significant losses.

Meeting Fund’s investment rules: In some circumstances, VC needs to follow the fund’s investment rules to invest in different stages, industries, follow-ons, and geographies… to achieve their desired outcomes. For example:

By diversifying their portfolio, VC can minimize their exposure to any particular investment and maximize the chances for overall success. This diversification can help them mitigate the risks associated with any particular company or sector.

Highlighting Track Record for Fundraising: Effective capital allocation enables VCs to showcase their track record and performance to prospective investors. It signals to potential investors that the VC firm has a well-defined investment strategy and the expertise to identify and support high-potential companies. This builds investor confidence and makes the VC firm more appealing to potential limited partners.

Venture capitalists are always on the lookout for the next big thing and invest in promising companies. However, with so many different companies and industries to keep track of, it can be difficult to assess investment risks and follow the investment strategies of the funds.

One way to keep track of invested capital is to group it by different variables like stage, industry, and country… This will help investors see where most of the money is going, and how it’s being distributed. In addition, creating charts in spreadsheets will help visualize the capital allocation. This can be helpful for making future investment decisions.

Capital allocation is a key part of successful venture capital investing. By keeping tabs on where the money is going, VC investors can ensure they’re making the best possible investment decisions.

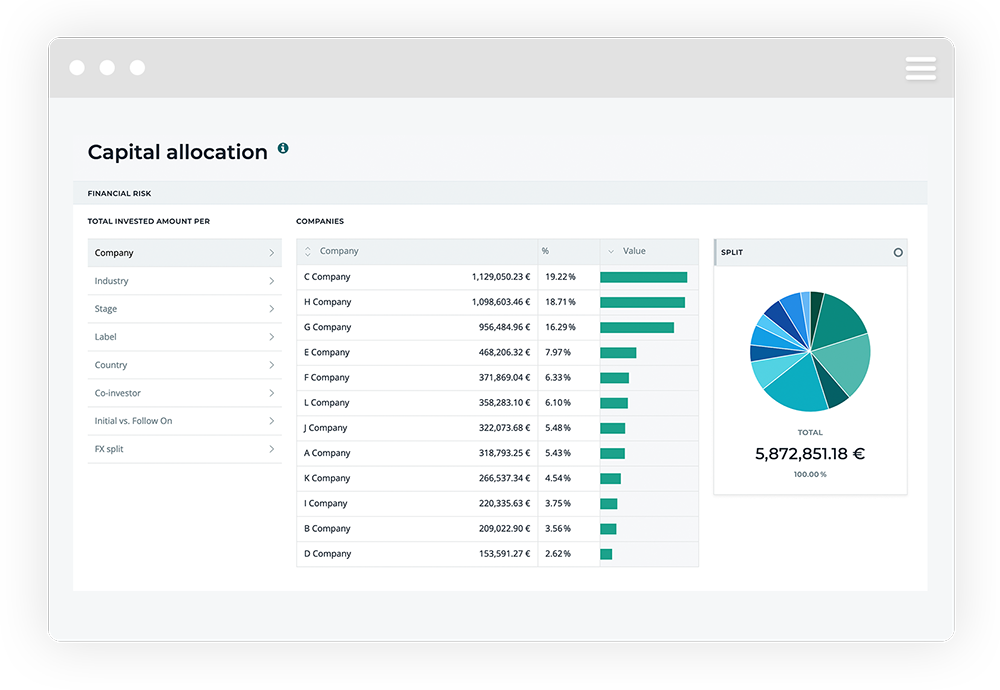

When managing investments in Rundit, investors can explore their investment allocation by different verticals, thus unlocking investment insights and improving risk assessment.

With this knowledge, VC investors can make informed decisions about their venture capital investments, and ensure they’re reaping the highest possible returns. Talk to our expert to learn more about our Capital allocation feature.

Get holistic insights and make decisions from a unified data source.