Table of Contents

Welcome to the February 2025 edition of the Rundit Monthly Roundup, your guide to the latest in startup and venture capital! 🚀 The VC world isn’t slowing down, and neither are we. Discover Rundit’s newest features to sharpen your investment strategies, explore exciting startups’ fundraising news, and mark your calendar for upcoming investor and startup key events.

Ready to take action? Dive into the full roundup now!

We’re constantly innovating to make your VC experience smoother and more insightful. Check out our latest features:

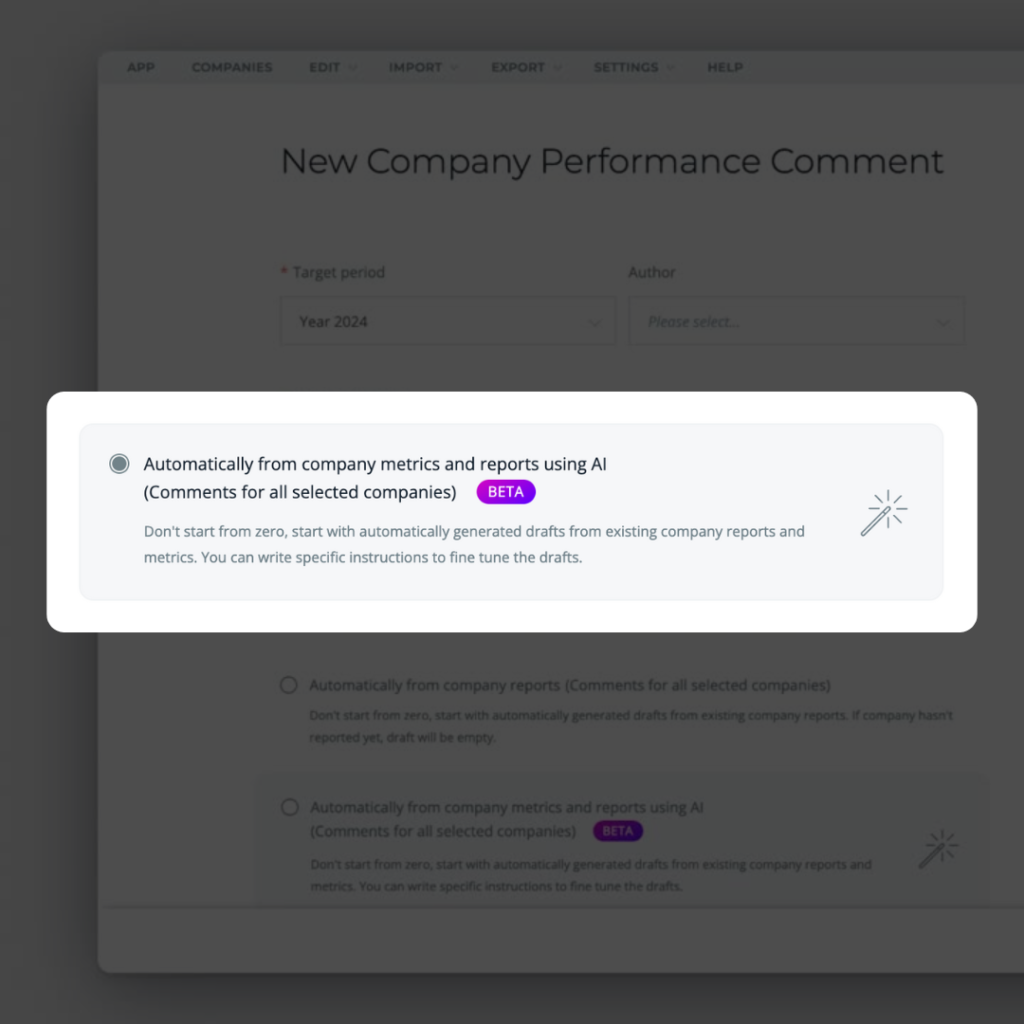

AI-tool for Company Performance Comments: Our cutting-edge AI-driven solution that crafts LP report comments by seamlessly integrating both portfolio company reporting metrics and insights from written reports. You will have the flexibility to tailor these AI-generated insights to perfectly align with your unique preferences.

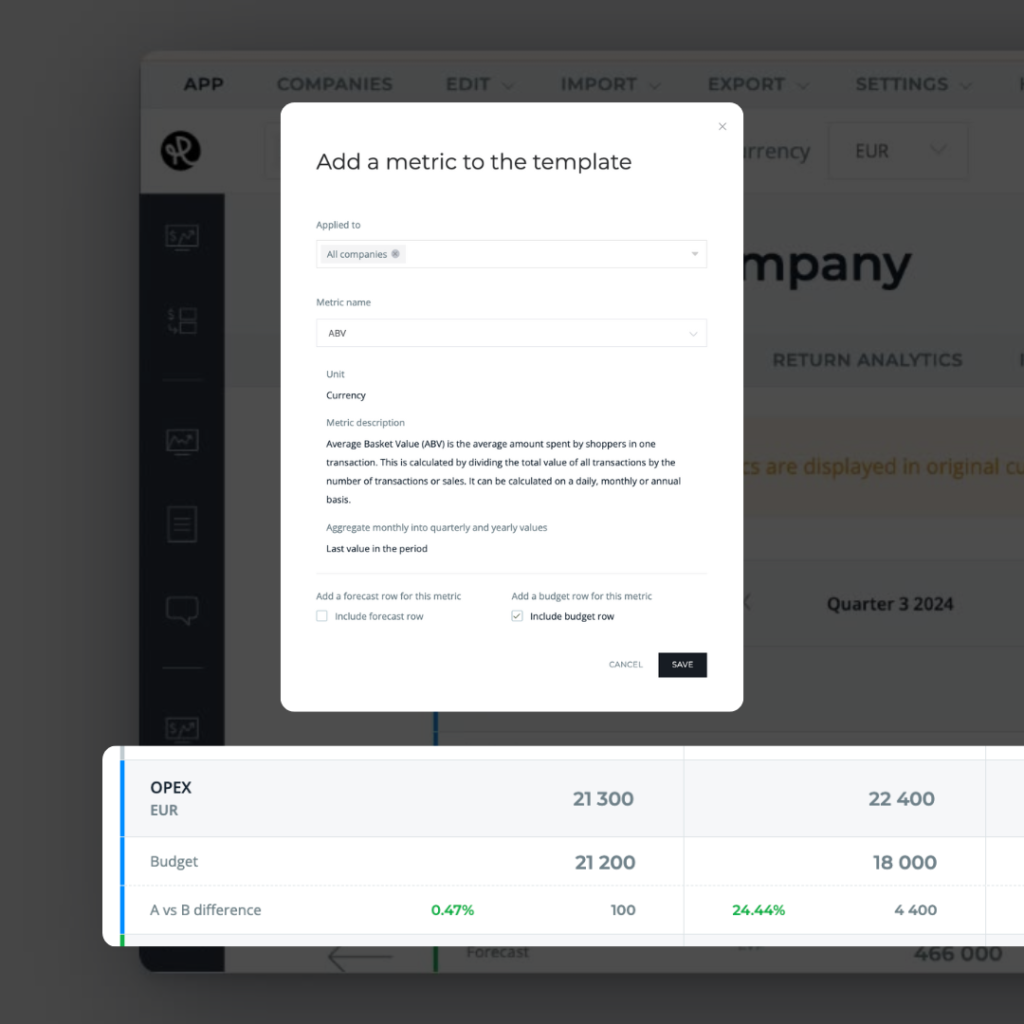

Budget for Company Metrics: Budget tracking can now be added to any company metric, allowing for more precise comparisons between planned and actual performance. This enhancement makes it easier to monitor progress, make informed decisions, and maintain cost efficiency.

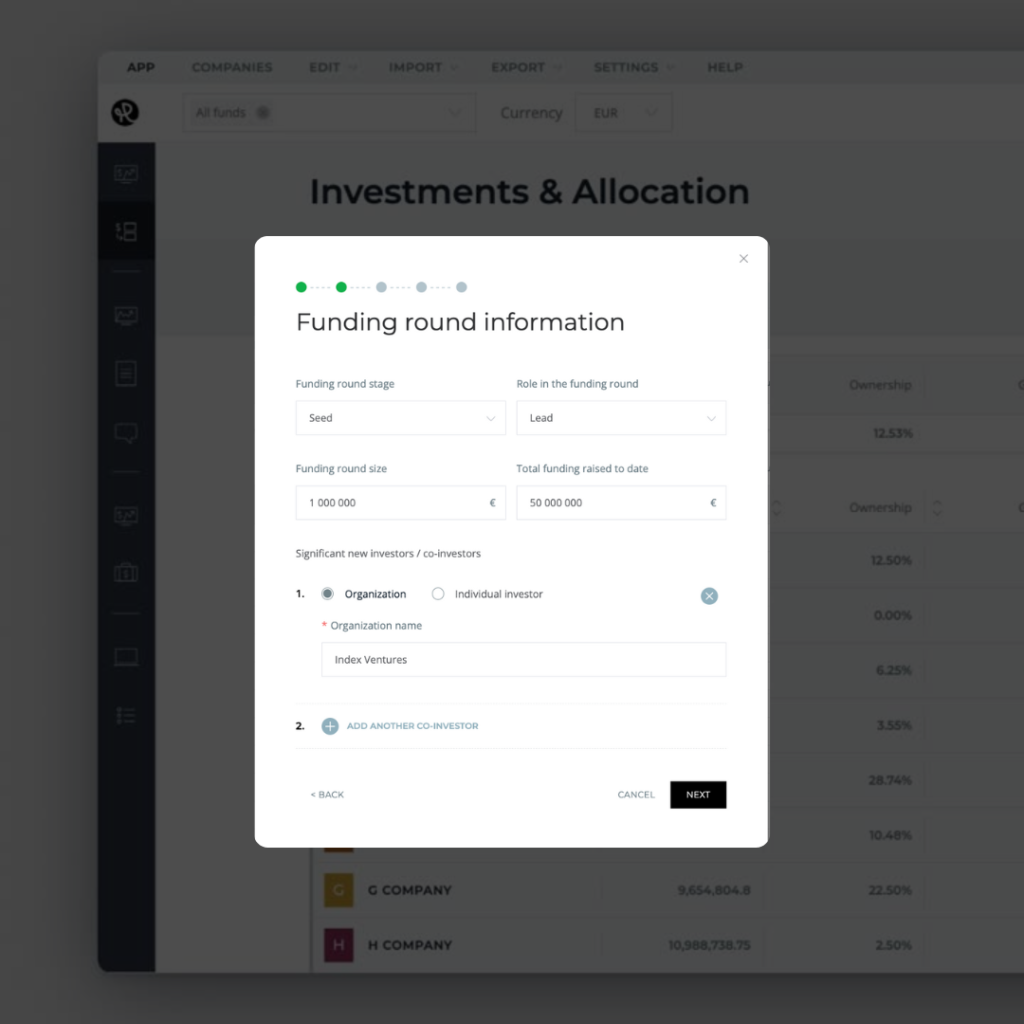

Funding Round Size & Total Funding To Date: Tracking your company’s funding just got more powerful! Now, round sizes and total funding raised are seamlessly integrated into investment flows, making them easily accessible in the Investment Overview, Company Dashboard, LP reports, and Excel exports.

Not yet a Rundit user? Join us here!

Here are some exciting startups currently fundraising:

Industry: Life Science

Round details: Seed – €3 million

We are enabling animal-free drug discovery using engineered microchips. With key patents granted and validation data from industry partners, we have shown 30% year-over-year growth with platforms delivered to 21 countries.

Industry: Materials, Sustainability, Recycling

Round details: Seed – $1,2 million

Carbon fiber (CF) is unsustainable, emitting ~30T of CO₂ per tonne produced, with 62,000T landfilled annually. Recycling is limited by toxic methods and low value. Phoenix’s solution preserves CF’s original specs, enabling reuse at 50% lower cost with 87% lower emissions, supporting ESG goals. The global CF component market is $53B in the EU. Phoenix aims for 500T throughput in 3–5 years.

Industry: Climate/ Sports Tech/ B2B Saas

Round details: Pre-Seed – $750,000

Lowr operates at the intersection of human connection and environmental impact, transforming the way people gather. From live events to global venues, we turn the largest carbon footprint—attendee travel—into insights and actions through gamified emissions reduction.

→ Interested in connecting with these startups? We’d be happy to make introductions – reach out to us at [email protected]!

Get featured in our newsletter and gain visibility to 10,000+ investors.

Microsoft for Startups Founders Hub offers up to $150,000 in Azure credits over four years, along with mentorship and resources like GitHub Enterprise subscriptions. This program is ideal for tech startups building software-based products or services, aiming to accelerate growth and find product-market fit.

The European Innovation Council (EIC) Accelerator offers a combination of grants up to €2.5 million and equity investments ranging from €0.5 to €15 million for innovative startups and SMEs. This program is designed for European companies with breakthrough innovations that have the potential to create new markets or disrupt existing ones, particularly in deep tech sectors.

Y Combinator is accepting applications for its Spring 2025 Batch, which will run from April to June in San Francisco. The program offers a $500,000 investment, with $125,000 for 7% equity and an additional $375,000 on an uncapped safe with “Most Favored Nation” terms. This opportunity is ideal for early-stage startups across all sectors looking for rapid growth and scaling. The application deadline is February 11, 2025, at 8 PM PT, with decisions announced by March 12, 2025

Mark your calendars for these can’t-miss events:

Europe

United States

📅 Don’t miss out! Subscribe to our monthly roundup for the latest industry trends, funding opportunities, and exclusive insights – delivered straight to your inbox!