Table of Contents

Welcome back to the Rundit Monthly Roundup, your guide to the latest in startup and venture capital! The VC landscape is transforming at lightning speed, fueled by AI-powered tools, private sector specialization, and a growing focus on ESG and sustainability. Beyond our usual newsletter highlights, this edition will explore the investment trends redefining how startups are funded and how investors are adapting to this new era. 📊 🌱💡

Check out the highlights on our platform this month!

Not yet a Rundit user? Join us here!

Dashboard Filtering by Labels & Industries: Gain deeper insights with filters! You can now filter the Investment Dashboard by labels and industries, making it easier to track relevant data. You can, for example, see how much you’ve invested in Female-Founded companies in FinTech or track your exposure to Seed-stage AI & Machine Learning companies.

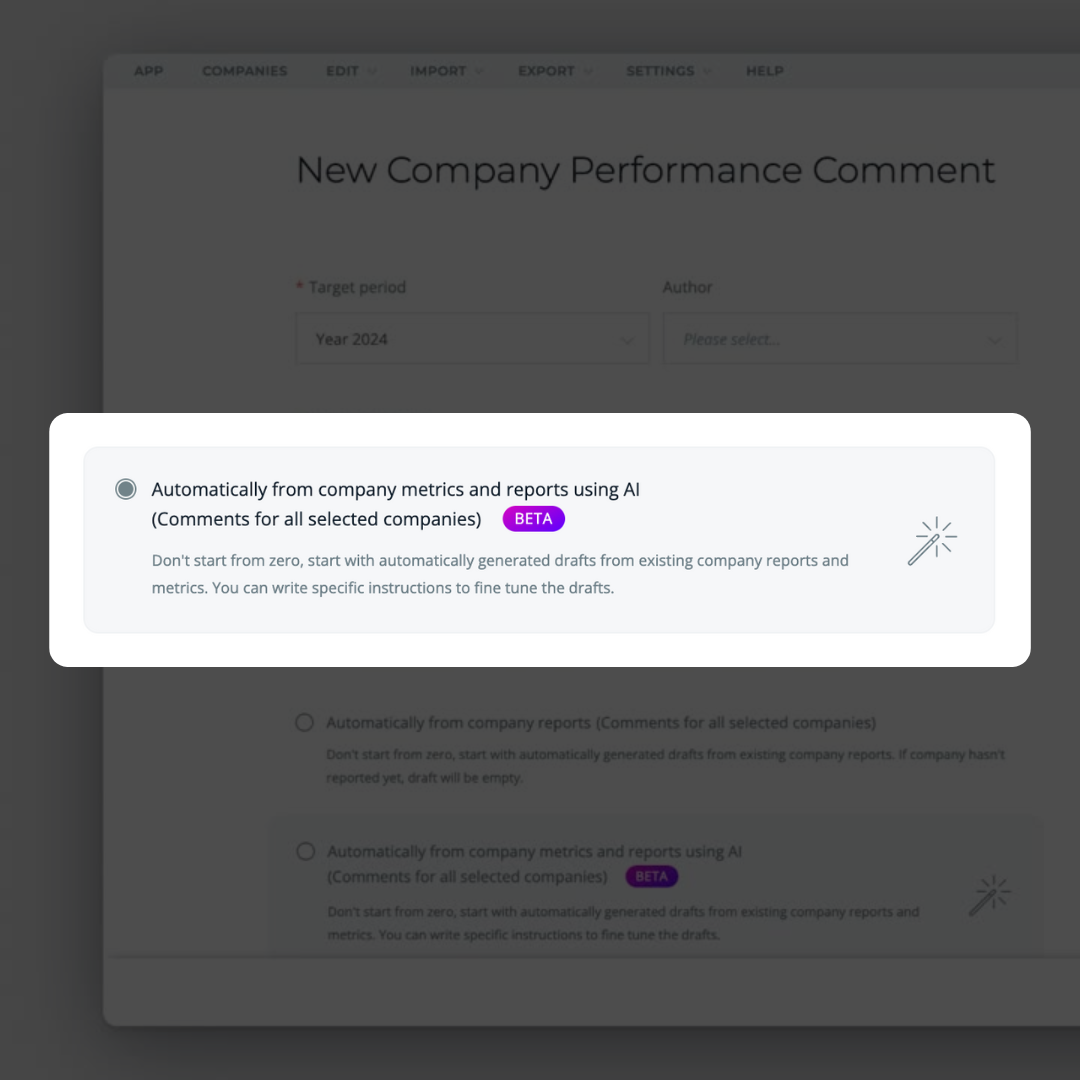

Generate Company Performance Comments with an AI-powered feature: Our cutting-edge AI-driven solution crafts LP report comments by seamlessly integrating both portfolio company reporting metrics and insights from written reports. You will have the flexibility to tailor these AI-generated insights to align perfectly with your unique preferences.

[Coming soon] Rundit Add-in for Excel: Managing investment data just got smarter! We’re excited to give you a sneak peek at the Rundit Add-in for Excel, a game-changing tool designed to streamline your workflow. Whether you’re analyzing portfolio performance, updating fund metrics, or preparing reports, this add-in bridges the gap between Rundit and Excel, making data transfers effortless.

Here are some exciting startups currently fundraising:

| GlycanAge | Croatia |

| Industry: Biotech, Longevity |

| Round details: Series A – €5 million |

| GlycanAge is revolutionizing health-tech and longevity with advanced blood biomarkers developed from 30+ years of research and 200,000+ sample analyses. Leveraging the world’s largest proprietary dataset of the human glycome, GlycanAge is leading the way in predicting and preventing age-related conditions, beginning with menopause, cardiovascular disease, and neurodegenerative disorders. |

| AHILAB | United Kingdom |

| Industry: SaaS |

| Round details: Seed (MVP with tractions) – £650,000 |

| Gen AI apps are everywhere—305M users, 3M apps—but most can’t make money because they lack the right data. Founded by an ex-Meta Data Scientist and a Silicon Valley Software Engineer, Ahilab solves this problem by turning AI interactions into useful insights. Our first focus: monetization. We built the first ad network for Gen AI apps, placing relevant, data-driven ads inside AI-generated content—like Google Ads but optimized for AI. We started a Gen AI focused startup accelerator program in October 2024 and completed it last month. As of today, we process on average 525K API requests a month and are tapping into a $3.3B market. We are raising £650K in funding, to scale to £60K MRR and 5M monthly API requests. |

| Vegaaniruoka.fi (Veru Oy) | Finland |

| Industry: Online Marketplace |

| Round details: Pre-Seed – €100,000 |

| Vegaaniruoka is Finland’s biggest vegan food e-commerce, growing 35% quarterly with €2,625 monthly revenue. Our team’s 10+ combined years in e-commerce gives us a unique set of skills and experience to dominate the market. Seeking €100K pre-seed to scale marketing, expand across Nordics, targeting €200K ARR and €1-2M acquisition. Join us? |

→ Interested in connecting with these startups? We’d be happy to make introductions – reach out to us at [email protected]!

Get featured in our newsletter and gain visibility to 10,000+ investors.

The venture capital ecosystem is experiencing a profound transformation fueled by advancements in AI technologies, a growing focus on niche sectors, and the emergence of groundbreaking funding approaches. Here’s a closer look at the forces reshaping the industry:

AI tools like Affinity, Cyndx, and TechScout are transforming how VCs identify and evaluate startups. These platforms analyze vast datasets to uncover hidden patterns, predict scalability, and reduce manual work, enabling faster and more informed investment decisions. For instance, AI can sift through thousands of potential deals, scoring them based on predefined investment criteria, and even predict which startups are likely to raise capital next.

Key benefits:

Venture capital is evolving, with two major trends shaping investment strategies: sector specialization and ESG (Environmental, Social, and Governance) considerations.

VCs are increasingly focusing on niche sectors, moving away from generalist funds. Key areas of interest include climate tech, AI-driven healthcare, and femtech. A recent study by Preqin shows that 56% of venture capital investors plan to increase their allocation to sector-specific funds over the next 12 months.

Why it matters:

ESG mandates are becoming increasingly important in VC portfolios. According to PwC’s 2022 Global Private Equity Responsible Investment Survey, 72% of private equity firms always screen target companies for ESG risks and opportunities during due diligence.

Emerging opportunities:

The convergence of sector specialization and ESG focus is creating a new landscape in venture capital, where deep expertise meets sustainable impact. Investors are seeking startups with industry-specific solutions that also align with global sustainability goals, potentially leading to more targeted and impactful investments.

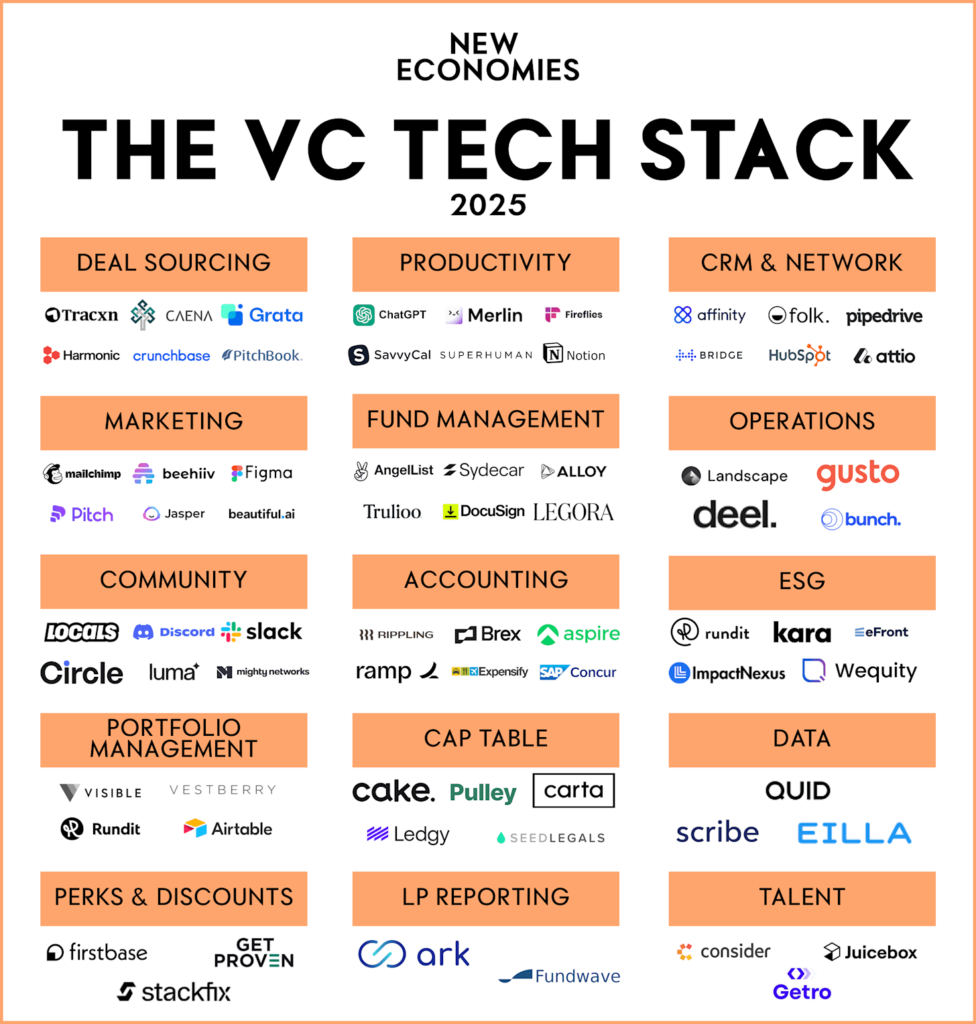

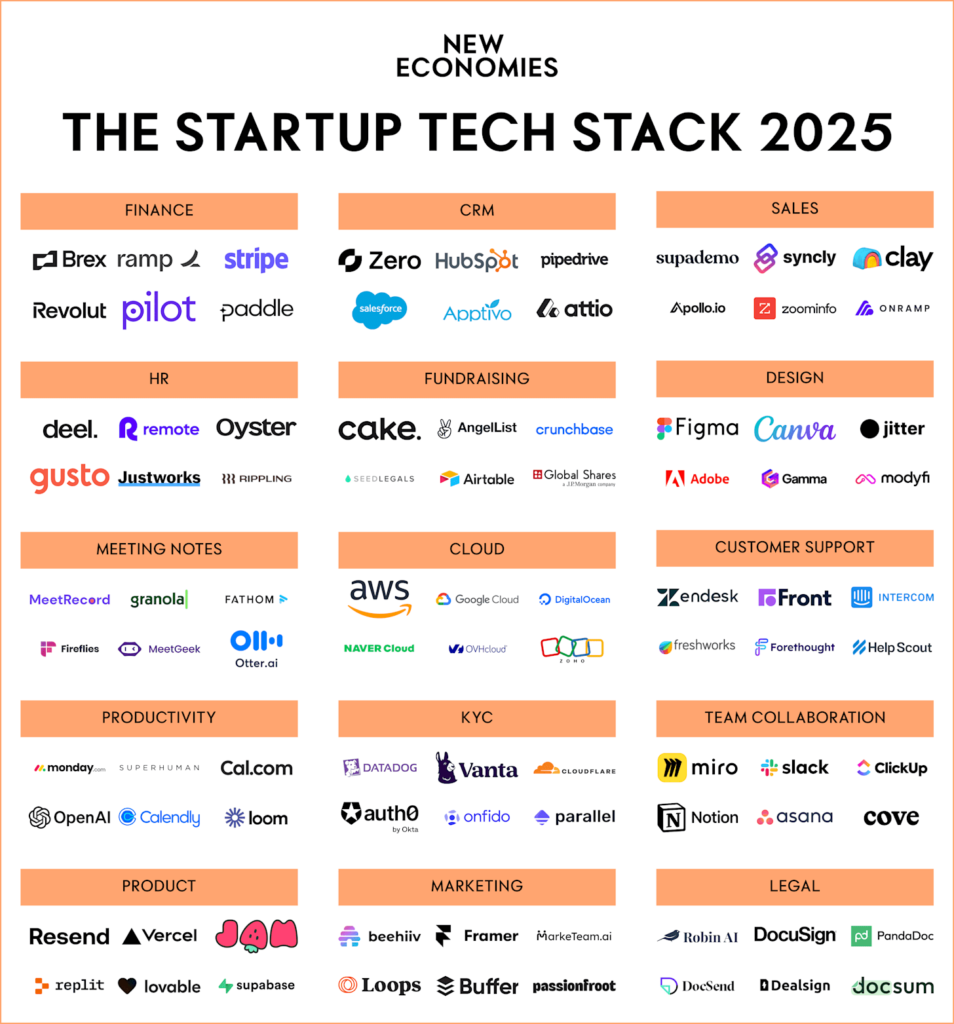

Here’s a breakdown of the 2025 tech stack for VCs and startups recommended by New Economies, highlighting the tools and platforms supporting investors to operate their funds and portfolio companies with their operations.

| VC Tech Stack |

| VCs are leveraging a suite of tools to streamline operations, manage portfolios, and enhance decision-making. Key categories include: |

| Startup Tech Stack |

| Startups are adopting cutting-edge tools to scale faster and optimize operations. Key focus areas include: |

Image from New Economies

Mark your calendars for these can’t-miss events:

Written by

Jolie Pham – Marketing Manager @ Rundit

Goran Bjelajac – CPO @ Rundit

📅 Don’t miss out! Subscribe to our monthly roundup for the latest industry trends, funding opportunities, and exclusive insights – delivered straight to your inbox!