Table of Contents

Welcome back to the Rundit Monthly Roundup, your guide to the latest in startup and venture capital (VC)! 📊 🌱💡 April has been a landmark month for VCs and startups, marked by record-breaking funding rounds, the unstoppable momentum of AI, and a wave of innovation across industries. In this edition, we spotlight Rundit’s latest product update, showcase standout startup fundings, break down how AI is reshaping VC portfolio management, global venture funding overview in Q1, and share the must-attend events for investors and founders this summer.

Ready to catch up on what’s shaping the industry this April? Let’s get started!

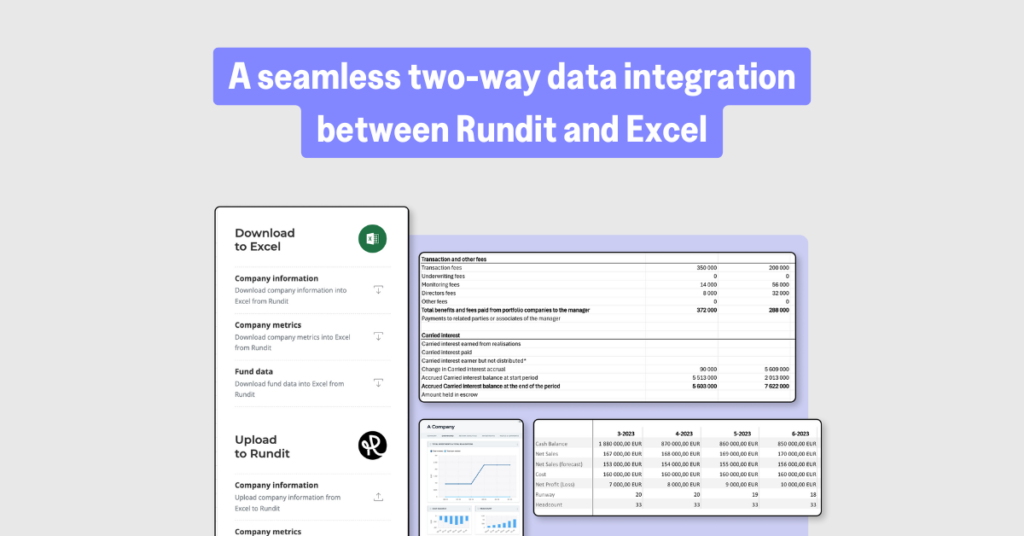

We’re thrilled to introduce the Rundit Add-in for Excel 🔥 – a powerful new way to make managing your investment data faster, easier, and more efficiently. Whether you’re diving into portfolio performance, updating fund metrics, or preparing detailed reports, this add-in seamlessly connects Rundit with Excel, cutting out manual work and saving you valuable time and effort.

It’s not just an add-in; it’s a workflow game-changer that lets you:

The add-in is available for Excel on Mac, Windows, and Excel online. Learn more and get started here!

Not yet a Rundit user? Join us!

Here are some exciting startups currently fundraising. If you’re interested in connecting with them, we’re happy to facilitate an introduction. Contact us at info@rundit.com!

| Minimass | United Kingdom |

|---|

| Industry: Construction |

| Round details: Seed – £2M |

Minimass is a patented low-carbon and low-cost design and engineering solution revolutionising large-scale construction, with applications ranging from warehouses to bridges. Structural elements (e.g. beams & frames) are manufactured in an innovative way – using 3D concrete printing – using half the quantity of material vs traditional concrete or steel construction for equivalent performance.

| Mykor | Portugal |

|---|

| Industry: Sustainable construction |

| Round details: Seed – £2,000,000 |

Mykor develops and scales next-generation building insulation for planet and human health with advanced biotechnologies. Our products offer 100% bio-based and carbon-sequestering alternatives to conventional insulation with better performance and at comparative price points. We engineer our products for construction applications using industrial residues, mycelium biotechnology, and green chemistry. Mykor’s products respond to the new requirements for insulation materials of today that 92% of construction products on the market do not address: fire safety, circularity, and low embodied carbon.

| Torram Labs Inc. | Canada |

|---|

| Industry: Blockchain / DeFi |

| Round details: Seed – $3M |

TORRAM is building the rails for the future of institutional DeFi and RWAs using Bitcoin as a natively secured settlement layer.

We’re making the Bitcoin blockchain more useful enabling companies/builders to build more robust applications that were not possible before on Bitcoin.

Web3 Analogy: If Chainlink + the Graph had a Bitcoin-native baby, that’s us, TORRAM.

Get featured in our newsletter and gain visibility to 10,000+ investors.

April is shaping up to be an exciting month for venture capital and startups, packed with headline-grabbing funding rounds, bold new trends, and the unmistakable surge of AI innovation. Fintech is roaring back to life, with global startups raising over $10 billion in Q1 alone, the highest since early 2023. And big names like Plaid and Mercury are leading the charge with massive deals. Meanwhile, according to AllyWatch and VC News Daily, fresh capital is fueling everything from healthtech to cybersecurity, as investors double down on sectors reshaping the future.

Here’s a closer look at some of the most significant startup investments this month:

| Startup | Industry | Amount Raised | Location | Notable Investors |

|---|---|---|---|---|

| Auradine | Web3/AI | $138M | Santa Clara, US | GSBackers, Samsung Catalyst, Mayfield |

| Chapter | Healthtech | $75M | New York, US | Addition, Stripes, Susa Ventures |

| ExaForce | Cybersecurity | $75M | San Jose, US | Khosla Ventures, Mayfield Fund |

| Vizzy | AI/Media | £3.65M | London, UK | Adjuvo, Rob Wells |

| SALZSTROM | Cleantech | $1M+ | Austria | Erste Group Bank AG |

| HyperFinity | Retail AI | 7-figure | Leeds, UK | Finance Yorkshire, River Capital’s fund:AI, Snowflake |

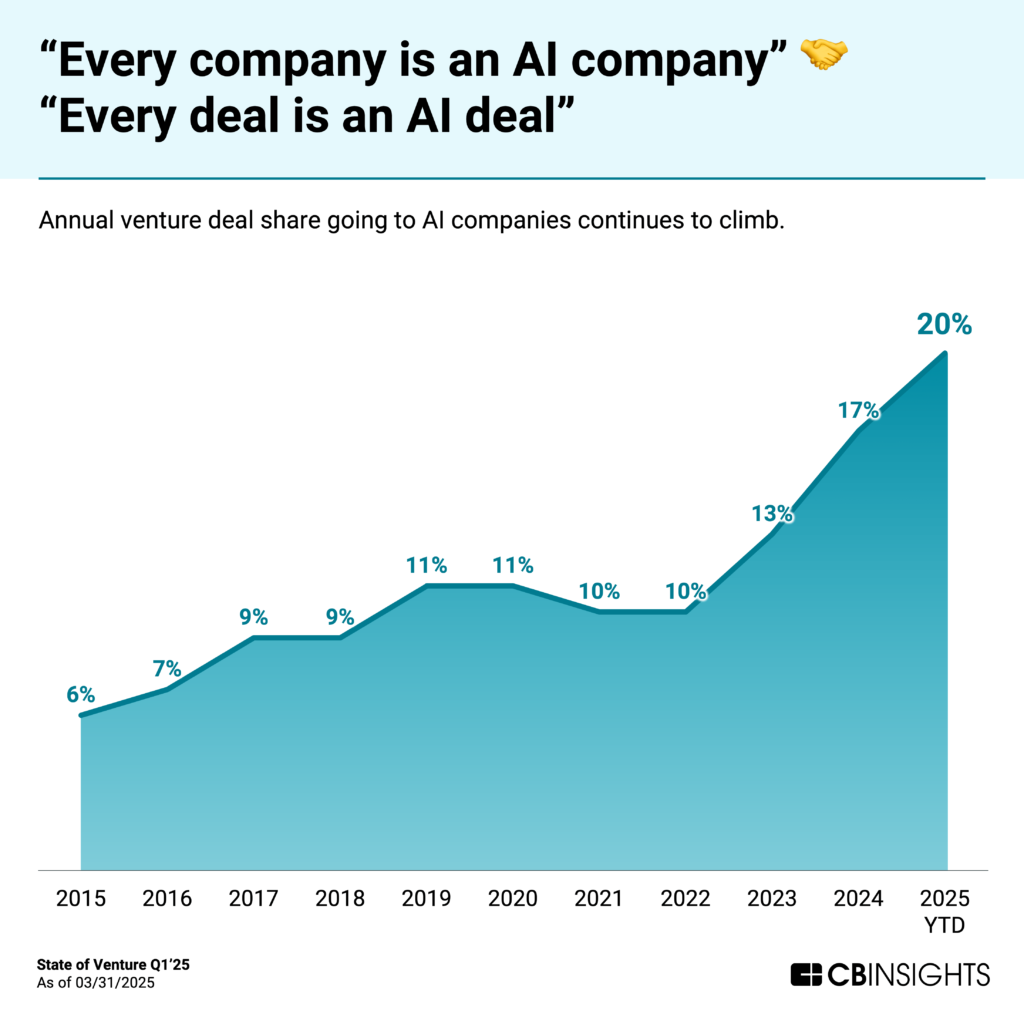

In Q1 2025, AI startups accounted for 20% of all global venture deals, marking a significant rise in deal share compared to previous years. AI captured about 58% of the total global venture capital dollars invested, approximately $73 billion. However, this reflects a concentration of capital rather than deal count, as the total number of AI deals was about one-fifth of all venture deals globally.

This means that although AI deals represent 20% of the total number of deals, they command a much larger portion of the funding by value, driven by mega-rounds such as OpenAI’s historic $40 billion raise. The AI sector’s deal composition is also maturing, with early-stage deals making up 70% of AI deals, down slightly from previous years, while late-stage deals are increasing.

Source: CB Insights

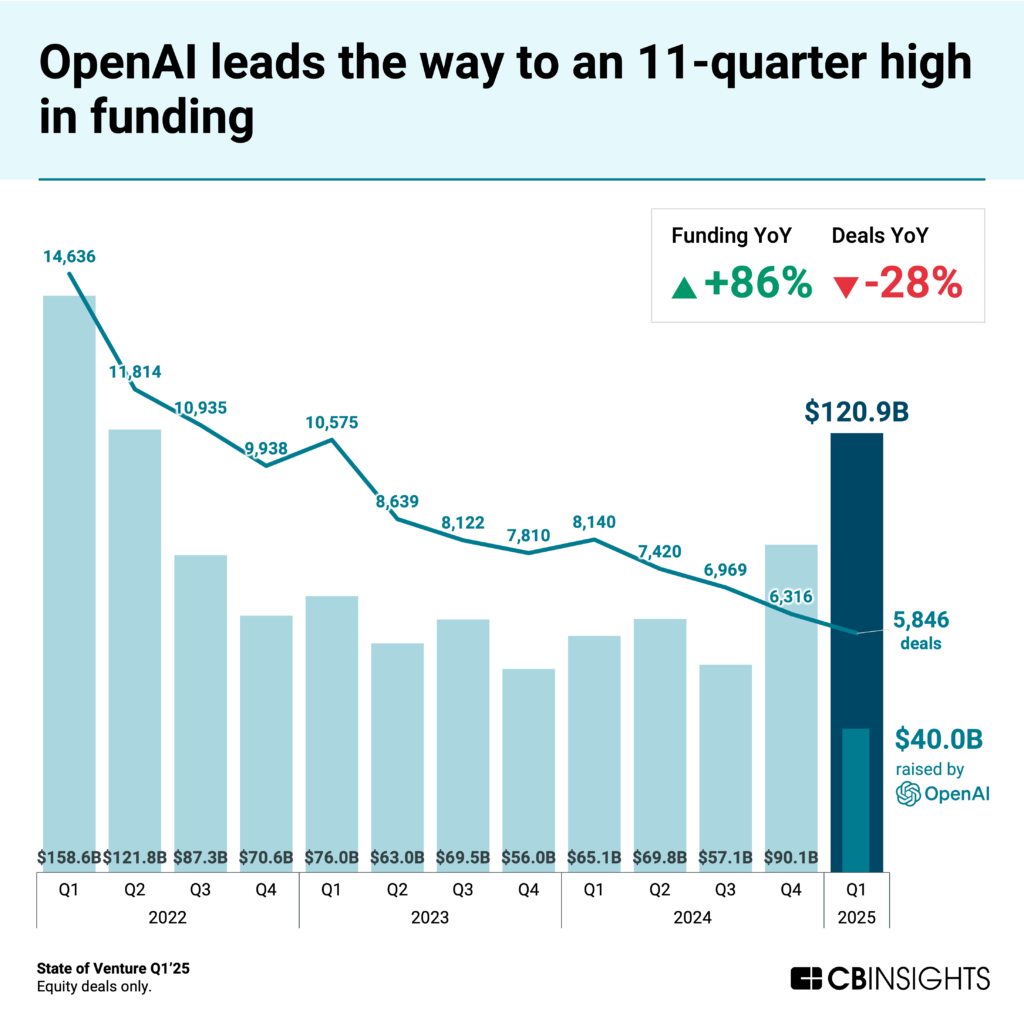

The Q1 2025 CB Insights report confirms it: global venture funding soared to $121B, the highest since Q2 22, despite a drop in deal volume. The story? Bigger bets on fewer, more specialized opportunities, especially in AI. Median early-stage deal sizes hit a record $2.7M, and AI startups captured a historic share of global VC, with eight early-stage AI companies landing $100M+ mega-rounds.

According to CB Insights report, AI now drives 1 in 5 global venture deals, with early-stage funding reaching record highs. Notable deals include OpenAI’s $40 billion funding round and Cyberhaven’s $100 million investment for AI-powered data security solutions.

Source: CB Insights

AI is fundamentally transforming how VCs operate, automating everything from deal sourcing to LP communications and helping firms save up to 40% of their time on routine tasks. Sustainability and global expansion are also in the spotlight, with funds like Fluent Ventures backing entrepreneurs who are scaling proven models into new markets.

Forget the days when AI was just a buzzword in venture capital. In 2025, it’s the engine powering smarter, faster, and more confident decisions across the entire investment lifecycle. Today’s top VC firms aren’t just experimenting with AI; they’re weaving it into the fabric of their daily operations, and the results are transformative.

Read more from our blog – Data-Driven Decision Making: How AI is Transforming VC Portfolio Management in 2025

Mark your calendars for these can’t-miss events:

Written by

Jolie Pham – Marketing Manager @ Rundit

📅 Don’t miss out! Subscribe to our monthly roundup for the latest industry trends, funding opportunities, and exclusive insights – delivered straight to your inbox!