Table of Contents

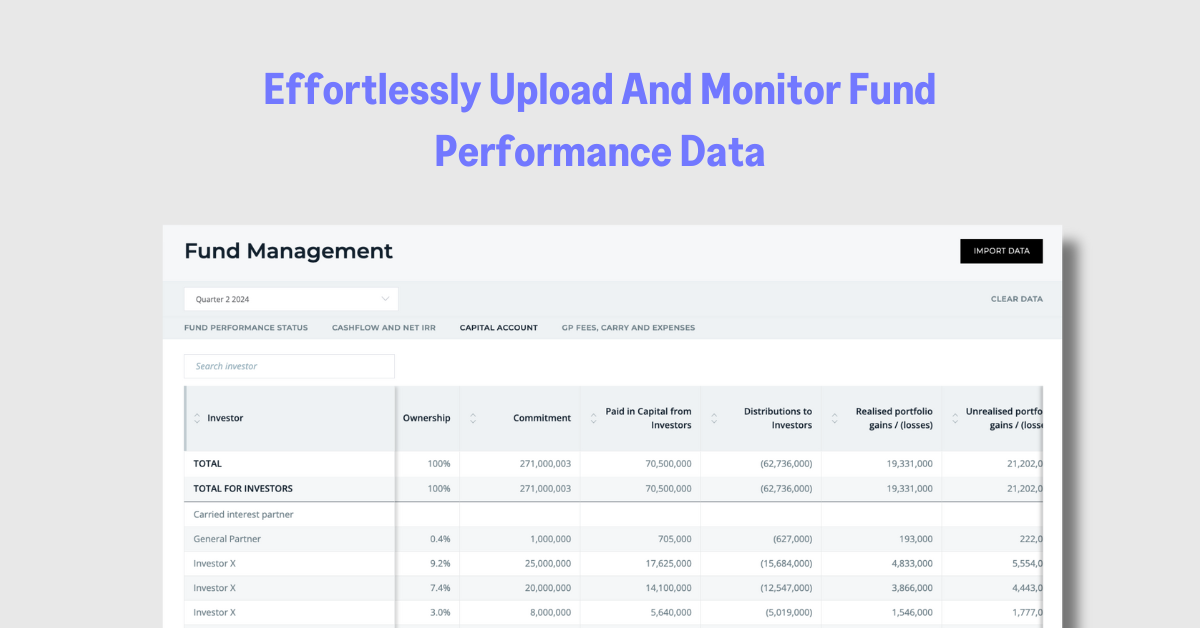

This September, we’re thrilled to announce the launch of a new powerful premium feature – Fund Management, a game-changer for venture capital and private equity firms looking to optimize their fund performance tracking and reporting. With this powerful new tool, you can now seamlessly upload, analyze, and visualize critical fund-level data directly within the Rundit platform.

Forget the hassle of juggling multiple spreadsheets and manual data entry. Our intuitive Fund Management feature allows you to easily upload and monitor key fund performance metrics, including:

Simply download our pre-formatted Excel template, fill in your data, and import it into Rundit with a few clicks. Our platform will handle the rest, providing you with a centralized, real-time view of your fund’s performance.

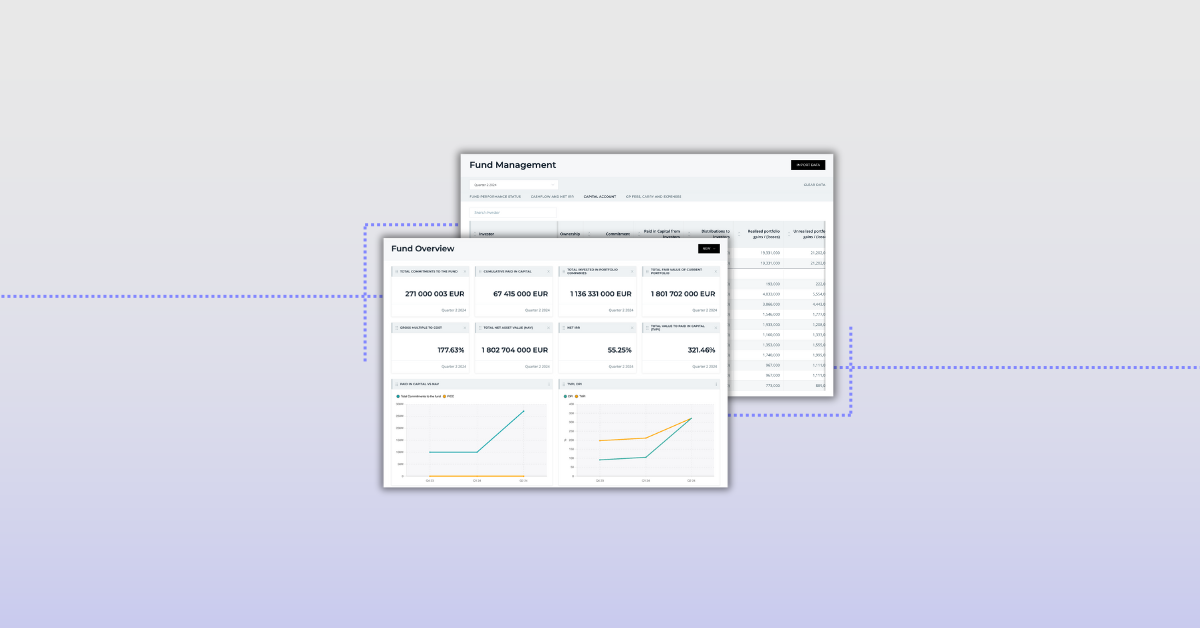

The Fund Overview dashboard empowers you to customize your view of fund-level metrics, such as TVPI, NAV, and Net IRR. Create personalized charts to track performance over time and make data-driven decisions with ease.By uploading historical data using individual templates for each period, you can gain a comprehensive understanding of your fund’s trajectory, enabling you to identify trends, spot opportunities, and make informed strategic choices.

With fund-level data seamlessly integrated into Rundit, you can streamline your operations and enhance the accuracy of your reporting. Say goodbye to manual calculations and inconsistencies, and hello to a more efficient, transparent, and compliant fund management process.

For a limited time, we’re offering all users, including non-premium members, the opportunity to experience our exclusive Fund Management feature for free for 30 days. Whether you’re a Pro or Pro+ user or haven’t joined Rundit yet, now is the perfect time to explore the full range of our Premium offerings and discover how Rundit can transform your fund management practices.

Don’t miss out on this game-changing opportunity. Schedule a demo call today and witness firsthand how Fund Management can revolutionize the way you track and report on your fund’s performance.