Table of Contents

To make informed investment decisions, venture capital investors need to manage a lot of data, including financial statements, market research, and due diligence reports. Many investors rely on spreadsheets to manage their data. However, spreadsheets have their limitations and can lead to errors and inefficiencies in data management. In this article, we’ll explore how to overcome the limitations of spreadsheets when managing investment and portfolio data.

Venture capital investors use spreadsheets to manage their data because they are a flexible and familiar tool that can be used to organize and analyze a wide range of information, plus other factors, namely its customization, cost-effectiveness, and accessibility:

Customization

Investors can customize their investment portfolio tracking spreadsheet to fit their unique needs, making it easier to track the information that matters most to them.

Cost-Effective

Excel can be a particularly advantageous tool for small venture capital funds to manage their data because it is both cost-effective and relatively easy to use.

Accessibility

Investment portfolio tracking spreadsheets can be saved in the cloud and data is accessible to the team members.

While spreadsheets can be a useful tool for managing investment data in venture capital, they do have some limitations. Three key elements that make spreadsheets a problem for investors are data aggregation, limited data analysis and limited team collaboration.

Data aggregation

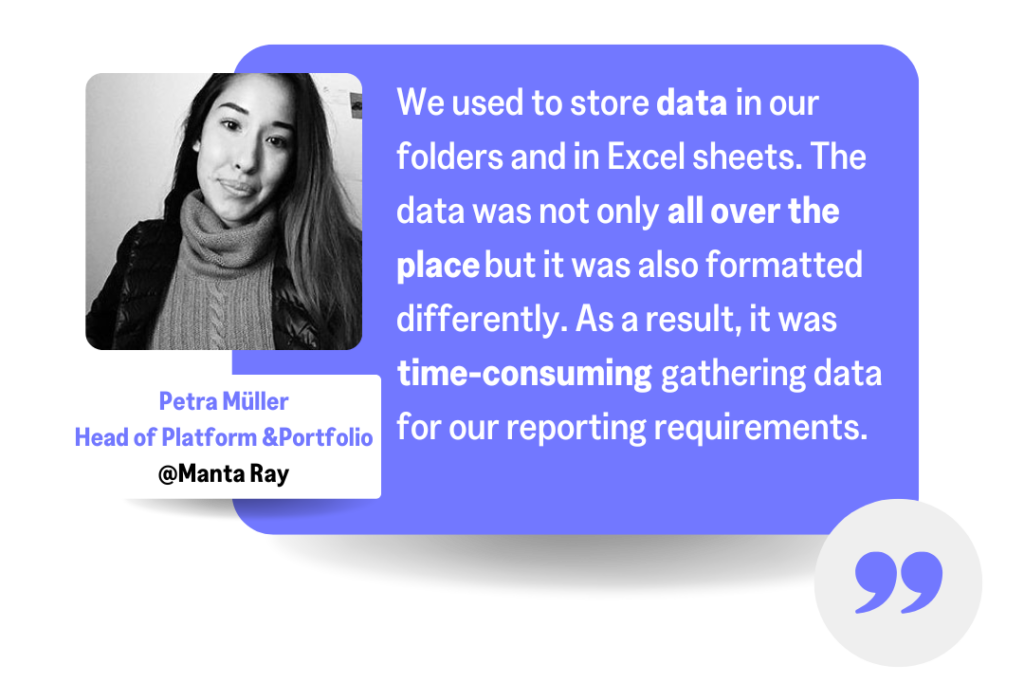

With all the report format and metrics which vary from company to company, there’s a ton of data scattered all over spreadsheets. As a consequence, aggregating data at the portfolio or fund level becomes more painful. VC teams globally are struggling with scattered data across spreadsheets and the manual task of putting all data together.

Limited Data Analysis

Spreadsheets have limited data analysis capabilities, which can make it difficult to gain insights into investment performance and make informed decisions. This can be particularly challenging in venture capital funds, where investments involve complex financial modeling, such as calculating return on investment, net present value, and other metrics.

The limited charting and graphing capabilities of spreadsheets may not be sufficient to provide clear and concise visual representations of complex data.

It is crucial to acknowledge that spreadsheets can become unwieldy and unmanageable as the amount of data grows. As a result, investors may find themselves struggling to navigate through their data and extract meaningful insights.

Limited Team Collaboration

While spreadsheets can be a collaborative tool, they can be challenging to collaborate on, especially when multiple parties are involved. Venture capital investments involve many stakeholders, including multiple investors, founders, and other parties. Thus, it can be difficult to track changes or maintain a complete audit trail of investment data, especially when multiple VC team members are contributing data to a single investment portfolio spreadsheet. Additionally, spreadsheets are prone to human error, such as incorrect data entry or formula errors, which can lead to inaccurate portfolio data and potentially significant financial losses.

Spreadsheets can be a useful tool for venture capital investors to manage their data, especially for smaller firms or for managing certain types of data. However, as firms grow and their data needs become more complex, they may need to consider a specialized portfolio management tool to ensure efficient data management. Since most of the VCs start with spreadsheets, finding a tool that provides seamless data integration from spreadsheets and a high level of automation will dramatically reduce the implementation cost.

Portfolio management and monitoring tool like Rundit powers a source of truth that brings all investment and portfolio data together via data integration and provide investors with holistic insights into their portfolio company and investment performance. Here’s how Rundit allows investors to break free from the problems of spreadsheets:

Improved Data Analysis: Rundit sends reminders to companies to report their performance metrics to their investors. Those metrics will be integrated into the platform and populated into charts that illustrate trends, growth patterns and overall performance. This automated process makes it easier for venture capital investors to analyze, benchmark, and gain insights at a company or fund level when all data is precisely aggregated.

Better Team Collaboration and Transparency: Rundit provides a centralized platform for team members to collaborate on investment data and share information effectively. Activity log ensures that changes are being tracked and communicated effectively.

Robust Portfolio Management Capabilities: Rundit investment management features will save investors time and reduce the likelihood of errors. These features include automatically calculating financial metrics, evaluating capital allocation, generating LP reports, and sending reminders to companies for reporting…

Overall, a portfolio management tool can help venture capital investors overcome the limitations of spreadsheets by providing more advanced data management, analysis, and reporting capabilities. Although managing all portfolio and investment data is challenging, it’s never too late to streamline the data flow in your VC team, so that your team can move forward and focus on what matters most. Let us walk you through this journey, have a chat with our experts today.

Get holistic insights and make decisions from a unified data source.