Table of Contents

A Convertible Note is a technique that seed investors use to invest in early-stage businesses whose valuation is not yet determined. It is a short-term debt structured to a start-up investment that isn’t ready to get evaluated yet. Once the company is valued, Convertible Note is changed into equity.

The amount of the note and its accrued interest will convert into shares of the specified stock at the close of round A financings.

For this reason, a convertible note will be easier to issue and comes with low legal fees for the company at that time.

For example, an investment company buys $25,000 of convertible notes which carry an 8% interest rate and a 20% conversion discount. Within a period of 18 months after selling the convertible notes, the firm trades equity at $3.50 per share. Up to this point, the total interest for the notes will be $3000, and the total amount due to the notes will be $28,000. With a discount of 20%, each share will attract a conversion price of $2.80 and the investor will garner 10,000 shares of the fresh stock. If the investor was to buy the ordinary shares during standard financing, they would only receive 7,143 shares. So, there is a big perk for investing in a convertible note.

A convertible note has many advantages. Here are some reasons why many start-up companies use them for fundraising.

Although Convertible notes come with multiple perks, they have various downsides. Here are the main ones:

A convertible note’s original structure is of a debt investment. However, the instrument allows the principal and accrued interest to convert to an equity settlement in the future.

Basically, convertible note investments are like debt instruments. The notes have terms on the interest rate and maturity. They will automatically convert into Equity if and when an equity round is raised. The conversion will always happen at a discount per share in a future round.

When assessing a Convertible Note, it’s important to evaluate the following parameters:

Rundit is an investment management software to support various transactions like convertible note investments.

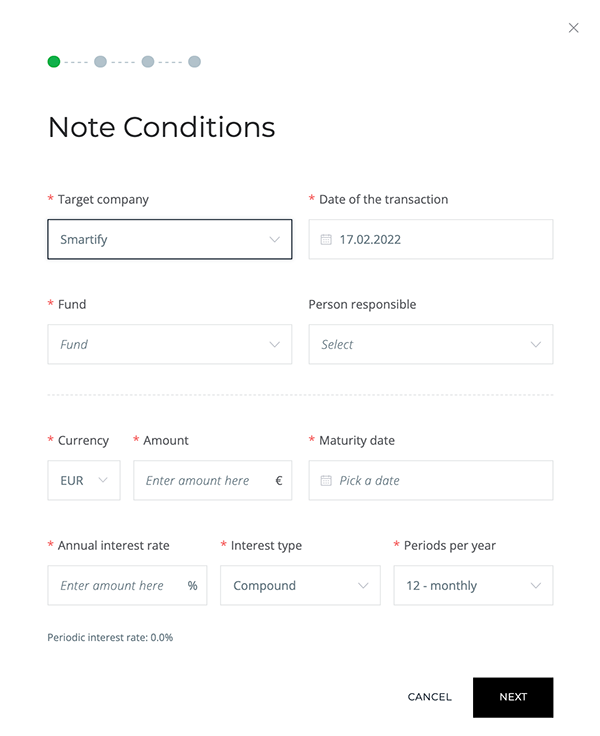

Convertible note transaction in Rundit

Investors can convert convertible notes into equity, pay-back or written-off debts with transparent details attached to each transaction. The platform will automatically calculate your fund holdings and investment returns accordingly. That said, you will put your mind at ease, and wait to reap the benefits of your investment.

If you have to use a convertible note, make sure you clearly understand both sides of the coin. Be sure to consider what could happen in different scenarios: If things go very well, your investment and accrued interest will translate to equity shares. On the other hand, however, your convertible note investment could go very badly, and you can’t raise enough equity.

An investment management tool like Rundit will help you manage your fund investment and track your portfolio to avoid bad surprises. Give Rundit a try today.

Get holistic insights and make decisions from a unified data source.