Are you a VC launching a new fund and you would like to gain visibility? Let us know and we will get you featured! Here are some of our VC clients that we’d like you to meet:

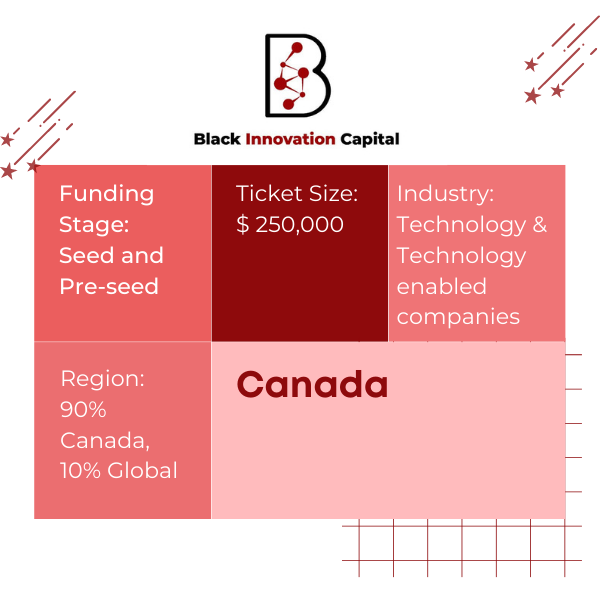

VC Description: Founded in 2021, Black Innovation Capital was built with the objective of investing in promising black founders in the technology space. We make early and transformational investments in disruptive companies often answering the unmet needs of minority communities. Additionally, we are intentional about our investment strategy and look to partner only where we can add value, with hard-working and visionary entrepreneurs.

Contact: [email protected]

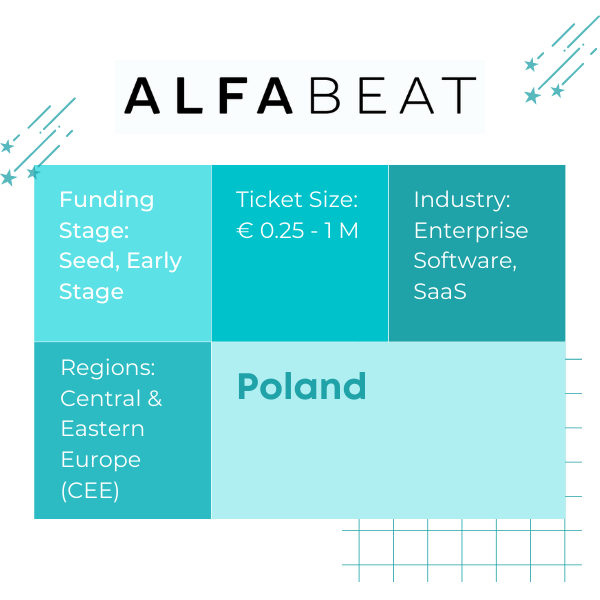

VC Description: Alfabeat is a specialist seed fund for Enterprise Software companies from Central and Eastern Europe, backed by successful Enterprise Software founders.

Contact: [email protected]

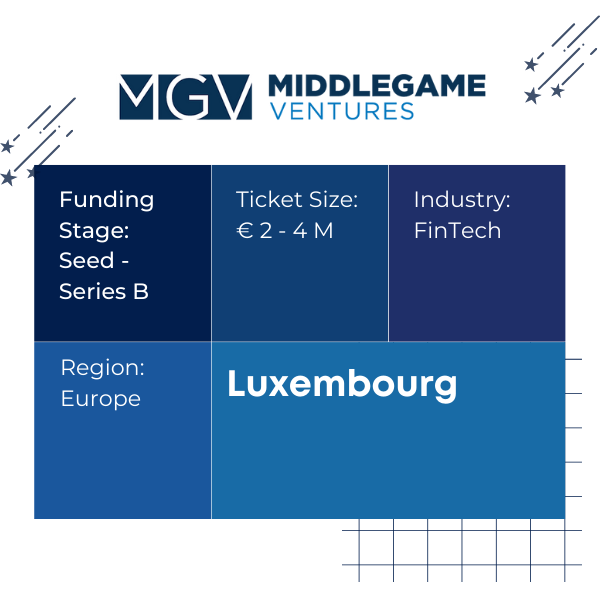

VC Description: MiddleGame Ventures is an early-stage pan-European FinTech-focused investment firm. We invest in the companies and founders that are changing the way businesses and consumers experience the future of financial technology. Over the past decade, our partners have invested over $300M across a range of FinTech sectors including banking, asset management, insurance, payments and capital markets. We bring to bear an essential and differentiated approach to investing and operations. Financial services innovation is our obsession and 100% our focus and we believe it will continue to be a true disrupter over the long term. Let’s continue the work.

Contact: [email protected] (for business plans); [email protected] for IR.

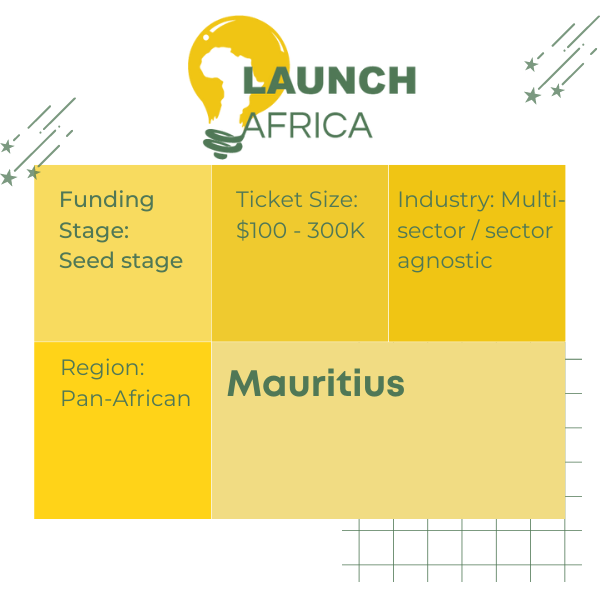

VC Description: LAUNCH AFRICA Ventures is a frontier Pan-African fund, a FIRST in Africa solving a significant funding gap and valuation arbitrage in the Seed to Series A bridge funding investment landscape in Africa. We invest in B2B and B2B2C early-stage technology-driven startups with strong, experienced management teams solving the most meaningful problems on the continent. We are founder-friendly and have simple, standard terms, investing $100k – $300k.

This and other mechanisms make the investment process as frictionless as possible from application to approval to disbursement (4-6 weeks). Our Fund uses our diverse networks and unique access to corporate distribution channels in the financial services, insurance, telecommunications, retail, media and technology industries across Africa and beyond to focus on key strategic relationships and unlock commercial opportunities for our portfolio companies. Our executive team are seasoned VC fund managers and Angel Investors with a strong network of partners across Africa and beyond. Currently we have 60+ investments in our Launch African Ventures portfolio.

Contact: [email protected]

Enhance productivity and boost transparency within your VC team