Table of Contents

ESG (Environmental, Social, and Governance) investing and reporting is on the rise. Companies that want strong access to investments and improved relationships with their existing investors need to take their ESG reporting to the next level.

ESG reporting is the disclosure of data associated with a business’s impact and added value to three main pillar areas: environment, social, and governance. While companies produce financial reports to measure profits, investment performance, IRR, and costs, they also report on particular ESG metrics to demonstrate how their business values and channels empathize with the three mentioned pillar areas.

For investors, ESG reporting is important as it enables VCs to engage with Limited Partners, and comply with evolving regulatory requirements:

Alignment with Stakeholders: ESG reporting enables VC investors to align their investments with the values and expectations of their stakeholders. Limited partners, institutional investors, and increasingly, individual investors, are demanding greater transparency and accountability regarding ESG factors. By considering and supporting companies with robust ESG practices, VC investors can meet these expectations and build trust with their stakeholders.

Meanwhile, startups that embrace ESG reporting demonstrate their commitment to responsible business practices, which can lead to enhanced competitive advantages, growth, and positive impact.

Learn more about ESG Reporting’s frameworks, challenges and approaches for Venture Investors in our white paper here.

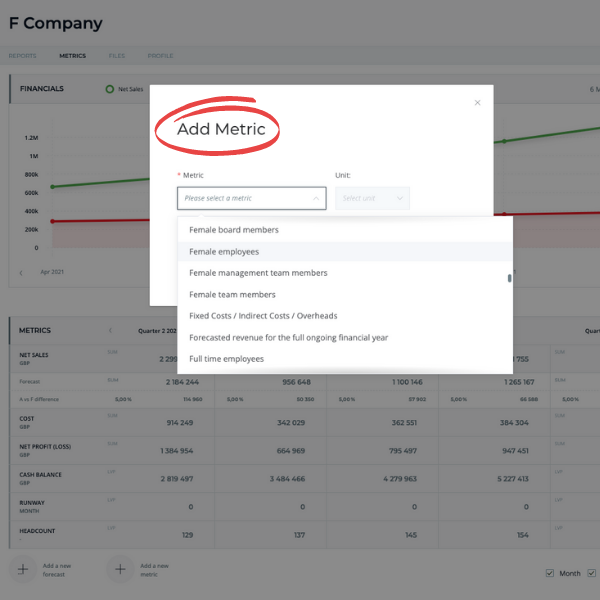

Rundit is a portfolio management and monitoring software that helps Venture capitals monitor and keep track of portfolio performance, including ESG performance. The platform allows investors to collect performance data from different companies, whether those KPIs are for marketing, finance, or ESG.

Examples of those KPIs include:

After portfolio company report to their investors, Rundit will aggregate all the data and display it in visual dashboards which give investors a better overview of how those companies are doing.

ESG reporting holds significant importance for both venture capital investors and startups. For venture capital investors, ESG reporting allows for effective risk mitigation by considering environmental, social, and governance factors in investment decisions, while also aligning with stakeholder expectations and attracting socially responsible capital. On the other hand, startups benefit from ESG reporting as it helps attract investment capital, gain a competitive advantage, and promote long-term sustainability.

Ready to streamline and simplify your ESG reporting process? Let Rundit assist you.

Get holistic insights and make decisions from a unified data source.